My Financial Independence Journey » Stock Analysis » Caterpillar (CAT) Dividend Stock Analysis

Caterpillar (CAT) Dividend Stock Analysis

Caterpillar (CAT) is the world’s largest producer of earth moving equipment, a major manufacturer of engines and electric power generators for the petroleum industry, and a major producer of mining equipment. CAT is divided into four main business segments: 1) Construction industries (29% of revenue) which provide machinery for construction and mining clients. 2) Resource industries (32% of revenue) which provides machines for forestry, mining, and tunneling clients. 3) Power systems (32% of revenue) which servers electric power, petroleum and rail-related markets. 4) Financial products (4% of revenue) which provides financing for clients to purchase CAT’s products. Like car loans for heavy equipment. All of these business segments are seeing growth in Brazil, Asia, and other developing economies.

Caterpillar (CAT) is the world’s largest producer of earth moving equipment, a major manufacturer of engines and electric power generators for the petroleum industry, and a major producer of mining equipment. CAT is divided into four main business segments: 1) Construction industries (29% of revenue) which provide machinery for construction and mining clients. 2) Resource industries (32% of revenue) which provides machines for forestry, mining, and tunneling clients. 3) Power systems (32% of revenue) which servers electric power, petroleum and rail-related markets. 4) Financial products (4% of revenue) which provides financing for clients to purchase CAT’s products. Like car loans for heavy equipment. All of these business segments are seeing growth in Brazil, Asia, and other developing economies.

CAT Basic Company Stats

- Ticker Symbol: CAT

- PE Ratio: 9.48

- Yield: 2.4%

- % above 52 week low: 7.1%

- Beta: 1.8

- Market cap: $52.7 B

- Website: www.cat.com

CAT vs the S&P500 over 10 years

CAT is crushing the S&P500. After 10 years an investment in the S&P500 would have grown by 74% compared to the 210% that an equivalent investment in Caterpillar would have grown.

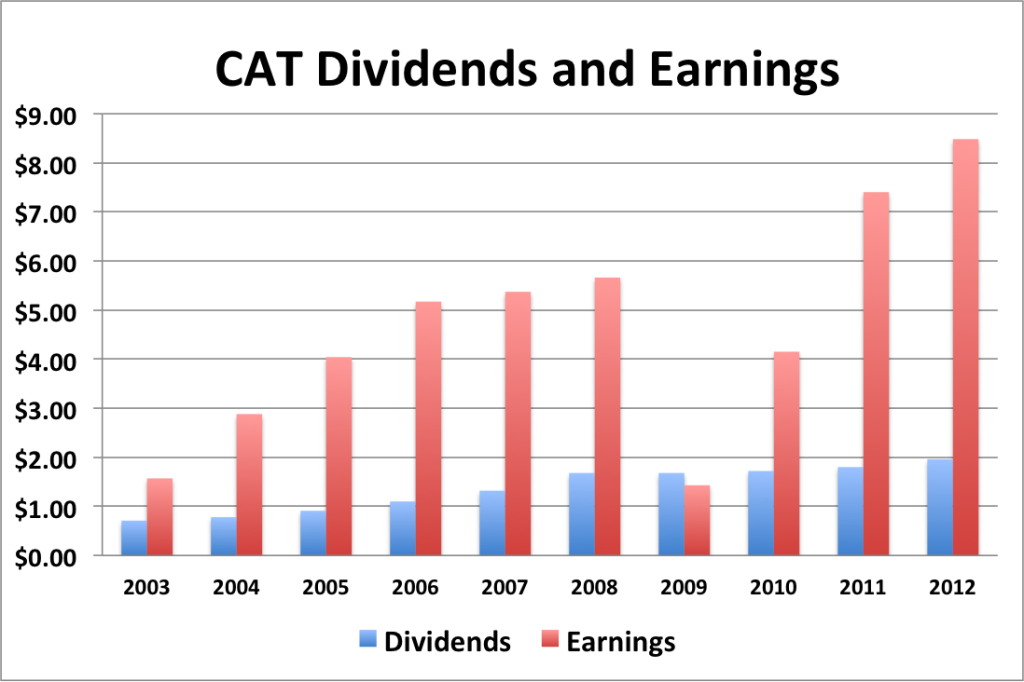

CAT Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: 14.6%

- 3 year EPS growth: 42.9%

- 5 year EPS growth: 10.6%

- 10 year EPS growth: 20.6%

EPS growth for CAT has been quite nice over the lat 10 years. EPS dropped like a rock in 2009 following the Great Recession, but then came roaring back over the last 3 years. Continuing EPS growth is critical to continued dividend growth, so these numbers make me optimistic.

- 1 year dividend growth: 8.9%

- 3 year dividend growth: 6.7%

- 5 year dividend growth: 3.9%

- 10 year dividend growth: 11.9%

Dividend growth for CAT dropped during the Great Recession, but now appears to be accelerating over the last 5 years. The 10 year growth rate is nearly 12%, which is quite nice. Given the EPS growth and the low payout ratio (see below) CAT should be able to sustain solid dividend growth for many years.

With a starting yield of 2.4% and a growth rate of about 10%, PG’s yield on cost will grow to about 6.5% in 10 years. In order to double the dividend, using the rule of 72, it will take approximately 7 years.

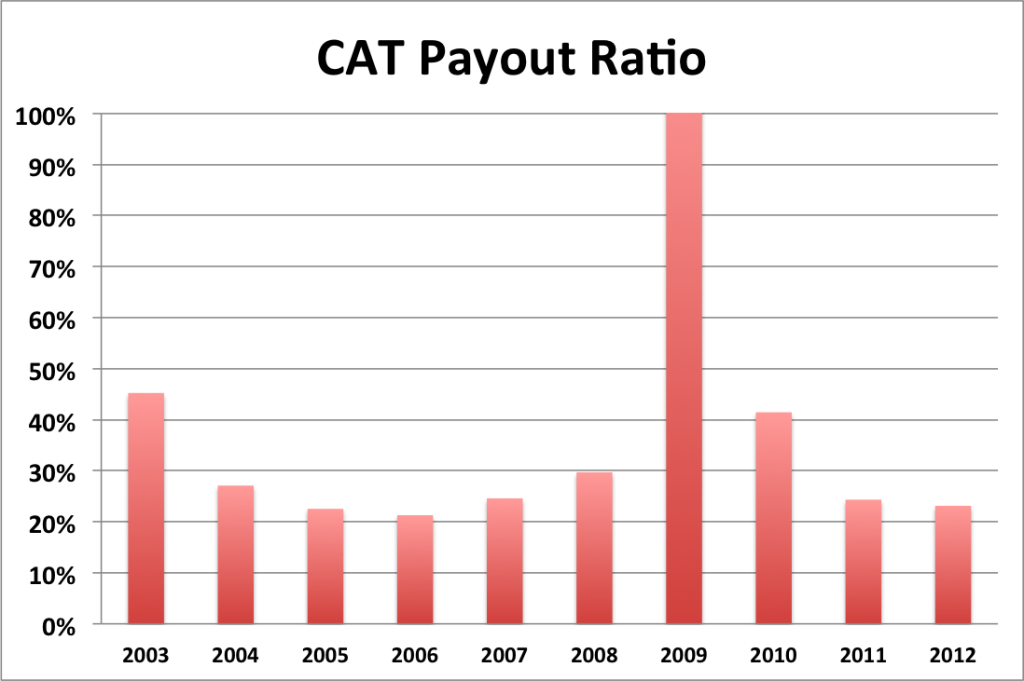

CAT Payout Ratio

CAT’s payout ratio has remained relatively flat in the 20-30% range. There was a substantial spike to 110% in 2009 due to substantially decreased earnings, but now that EPS has returned to normal, so has the payout ratio. The low payout ratio leaves CAT with lots of room to grow its dividend over time.

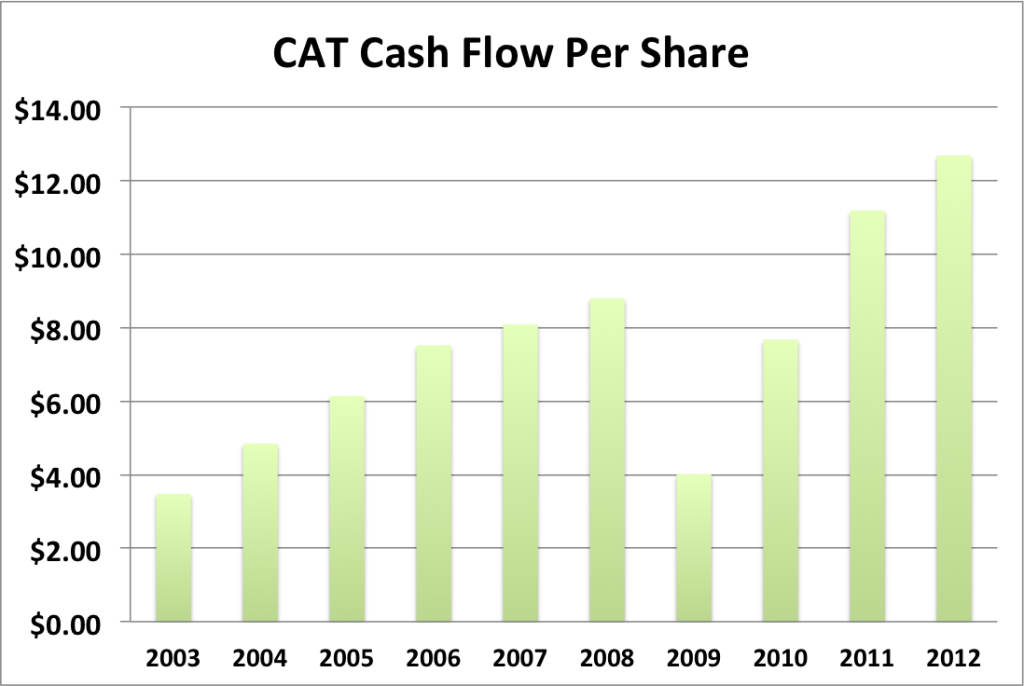

CAT Cash Flow & Revenue Growth

- 1 year revenue growth: 9.5%

- 3 year revenue growth: 24.4%

- 5 year revenue growth: 6.4%

- 10 year revenue growth: 12.5%

CAT’s revenue growth and cash flow follow the exact same pattern as its EPS and dividends – namely solid growth followed by a big drop during the Great Recession, and then a rapid recovery.

CAT Balance Sheet

The current debt to equity ratio for CAT about 49%, which is a bit lower than other equities (~40%). However, the historical debt is high, often exceeding 100%, but this does not appear to have hindered CAT’s profitability, so I am inclined not to worry much about it.

CAT Risks

The biggest risk to CAT at this time would be another economic slow down and any associated reduction in demand for the kinds of capital construction equipment that CAT supplies.

A more short term risk involves accounting fraud. Back in 2012, CAT took over a company called ERA Mining Machinery. Later on, it was discovered that there was some questionable accounting on ERA’s books that occurred several years before the CAT takeover. CAT is currently writing down these losses, so expect another dip in earnings. In the long term, I do not see this as a major issue.

CAT Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for CAT is $71.45. The current stock price is well above that, suggesting that CAT may be overvalued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 1.8, the CAPM model provides a discount rate of 24.4%. Using a growth rate of 9% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $15.80. I also tried this model with a discount rate of 10% and got $83.08.

Gordon Growth Dividend Discount Model

Using the 24.4% discount rate, this model returns a value of $14.72. Using a more conservative 10% discount rate we get a value of $226.76.

Valuation Conclusion

Of the five different models tested, the median value is $71.45, which is lower than CAT’s stock price suggesting that it is overvalued at the moment. I also think that $83.08 is reasonable estimate, so my conclusion would be that CAT is either fair or a bit over valued at the moment.

CAT Cash Secured Puts

CAT is likely fair valued at the moment based on the valuation models and P/E ratio. CAT is also hovering around it’s 52 week low. This makes it a great candidate to sell puts against.

Conclusions

Overall, I really like CAT. Its dividend yield (~2.4%) is below what I would consider a minimum entry yield (~2.7%), so I wouldn’t buy the stock outright. However, I think that this stock is a great candidate to sell puts against. If the put expires in the money, you’ll be assigned the stock. Since the proceeds from the put are subtracted from the cost basis of the stock, that will drive the starting yield up towards my minimum entry point.

Disclosure: I am short one CAT put.

Readers: What are your opinions about Caterpillar?

Filed under: Stock Analysis · Tags: cat, caterpillar, stock analysis

Very insightful analysis. The only other metric I was looking for and is one that I usually have to calculate myself is the return on assets. I do like to see dividend yields above 3% (and for the right reasons), but the prospect of continual dividend growth is enticing.

I like that chart of CAT vs the S&P500 over 10 years. If only more stocks had that kind of performance right? Paying attention to dividend rates before investing is a smart idea.

I try not to invest in a stock if it won’t give me at least a 2.7% or so starting dividend rate. I’d prefer above 3%, but I’m willing to go down if there has been great growth of the company and the dividend.

It’s an interesting stock in term of dividend payout and relatively safe and sustainable business model.

Can you provide additional info in regards to 2009 and 2010 EPS slump? Considering the past 3 years div growth (therefore ignoring 2009 EPS down), you may expect to buy CAT at a 2.4% dividend yield that will rapidly hit your 2.7% minimum requirement. I’ve done that with KO about a year ago and I’m now getting close to my minimum accepted yield (3%).

I like CAT and wish I had jumped in after the financial collapse. I have also seen CAT used as an economic indicator predicting both good times and bad. I think selling a put at these levels is a smart bet.

Interesting. I really wouldn’t have thought of them without this piece. I’m going to put this in my “keep an eye on” file…

I really like the CAT business. One of my big regrets was flipping the stock a year or so after I picked it up in early 2009 @$31. While I managed a nice double from the sale, I regret losing a great business that I managed to pick up at a 5% yield on cost. The yield is too low to get me back in at present.

Talk about hindsight being 20/20. Oh well, there’s always more great companies out there. And if CAT stumbles again, you can always grab some.