My Financial Independence Journey » Stock Analysis » Emerson Electric (EMR) Dividend Stock Analysis

Emerson Electric (EMR) Dividend Stock Analysis

Emerson Electric (EMR) is an industrial conglomerate operating in five primary business segments: Process Management (31% of sales), Industrial Automation, Network Power, Climate Technologies, and Commercial & Residential Solutions. The company generated about 45% of revenues in the U.S. and Canada during F2012, with another 24% from Asia, 20% from Europe, 6% from Latin America, and the remainder from the Middle East and Africa. Process management (31% of sales) process management software and systems, analytical instrumentation, valves, control systems for measurement and control of fluid flow, and integrated solutions for process and industrial applications. Industrial automation (21% of sales) makes industrial motors and drives, transmissions, alternators and controls for automated equipment. Network power (25% of sales) makes power systems and precision cooling products used in computer, telecommunications and Internet infrastructure sold mainly to large data centers. Climate technologies (15% of sales) makes home and building thermostats and compressors (cooling components used in heating and air conditioning units and refrigerators). Commercial and residential solutions (7% of sales) makes various household appliances, hand held tools, piping and other related equipment, and storage solutions used in various industries.

Emerson Electric (EMR) is an industrial conglomerate operating in five primary business segments: Process Management (31% of sales), Industrial Automation, Network Power, Climate Technologies, and Commercial & Residential Solutions. The company generated about 45% of revenues in the U.S. and Canada during F2012, with another 24% from Asia, 20% from Europe, 6% from Latin America, and the remainder from the Middle East and Africa. Process management (31% of sales) process management software and systems, analytical instrumentation, valves, control systems for measurement and control of fluid flow, and integrated solutions for process and industrial applications. Industrial automation (21% of sales) makes industrial motors and drives, transmissions, alternators and controls for automated equipment. Network power (25% of sales) makes power systems and precision cooling products used in computer, telecommunications and Internet infrastructure sold mainly to large data centers. Climate technologies (15% of sales) makes home and building thermostats and compressors (cooling components used in heating and air conditioning units and refrigerators). Commercial and residential solutions (7% of sales) makes various household appliances, hand held tools, piping and other related equipment, and storage solutions used in various industries.

EMR Basic Company Stats

- Ticker Symbol: EMR

- PE Ratio: 17.42

- Yield: 3.0%

- % above 52 week low: 70.3%

- Beta: 1.36

- Market cap: $39.67 B

- Website: www.emerson.com

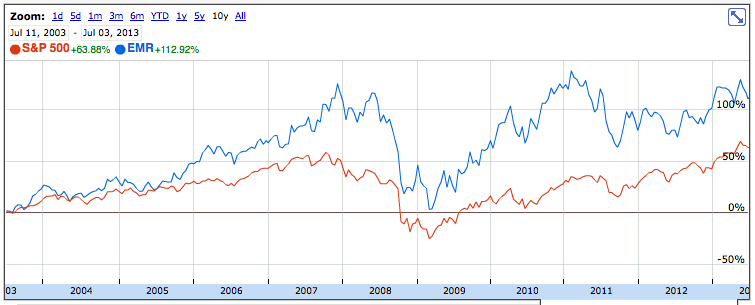

EMR vs the S&P500 over 10 years

EMR has generally exceeded the S&P500 over the last 10 years. Over that time, an investment in EMR would have grown by 113% compared to the 64% that an investment in the S&P500 would have grown. Capital gains almost double that of the S&P500 is pretty solid performance.

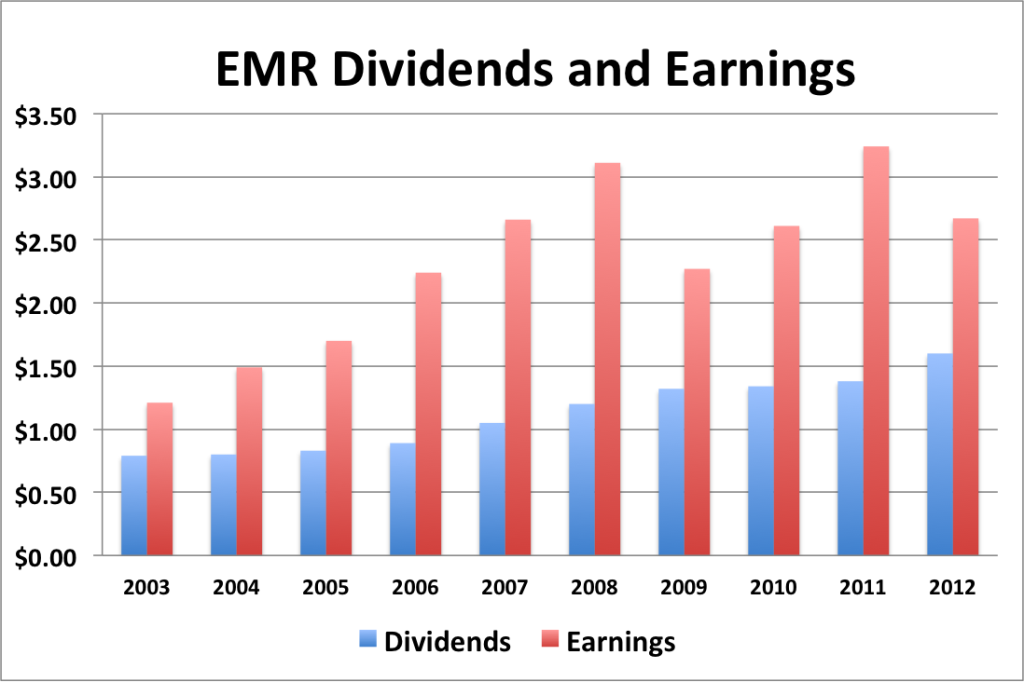

EMR Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: -17.6%

- 3 year EPS growth: 1.1%

- 5 year EPS growth: -3.7%

- 10 year EPS growth: -9.2%

EPS growth for EMR was generally upwards until 2009 when it started falling due to the recession. Then EPS growth continued its upward trend until 2012 where it dipped again.

- 1 year dividend growth: 15.9%

- 3 year dividend growth: 9.3%

- 5 year dividend growth: 7.5%

- 10 year dividend growth: 8.2%

Dividend growth for EMR has been great. 8.2% over 10 years is pretty solid growth for an established company like EMR. And if we look at the 1, 3, and 5 year dividend growth it looks like its accelerating. Another good sign for a dividend investor.

With a starting yield of 3.0% and a growth rate of about 8%, EMR’s yield on cost will grow to well in excess of 6.5% in 10 years. In order to double the dividend, using the rule of 72, it will take less than 9 years.

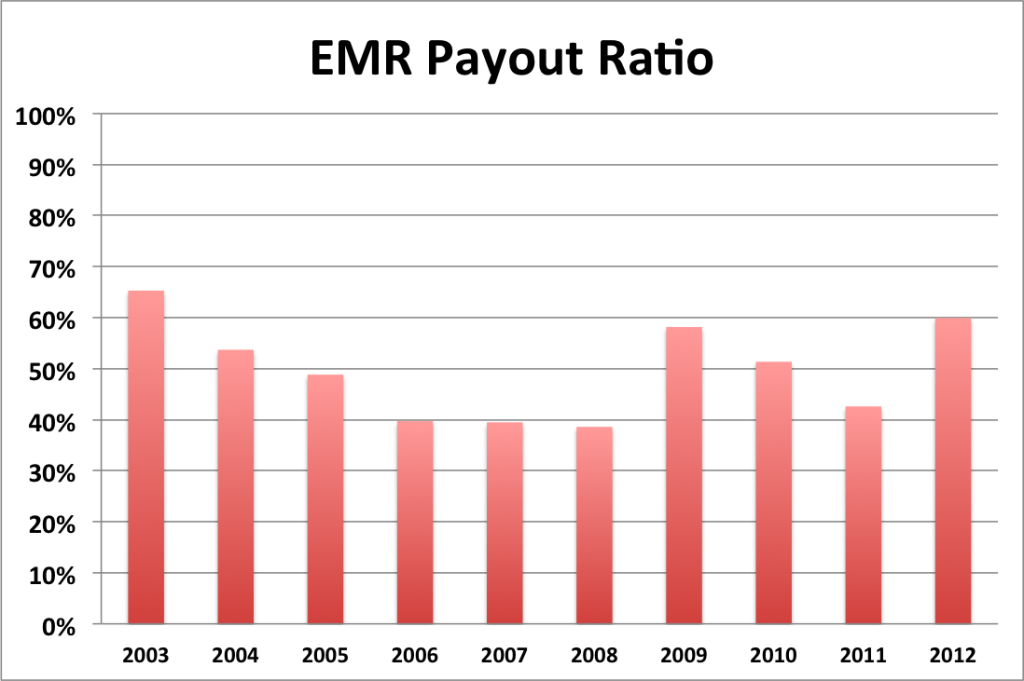

EMR Payout Ratio

EMR’s payout ratio seems to fluctuate from the high 30′s% to the mid 60′s%. The average payout ratio is 50% which seems to be in line with graph above.

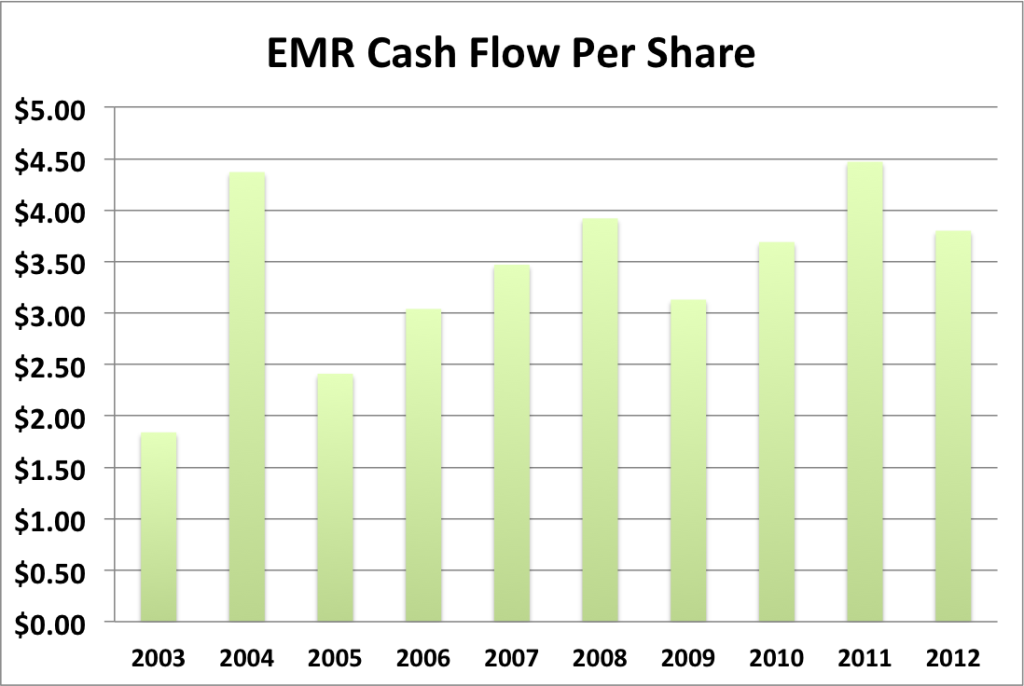

EMR Cash Flow & Revenue Growth

- 1 year revenue growth: 0.8%

- 3 year revenue growth: 7.7%

- 5 year revenue growth: -0.4%

- 10 year revenue growth: 6.4%

EMR’s cash flow per share has been inconsistent, but generally displays an upwards trend. Revenue growth has also been similarly inconsistent but upwards. Given that EMR operates in the industrial sector, it’s revenue, cash flow, and earnings are sensitive to economic conditions.

EMR Balance Sheet

The current debt to equity ratio for EMR is about 37%. The debt to equity ratio has hovered around this level for the last 10 years as well going as low as 26% and as high as 58%. Overall, I don’t see any problems here.

EMR Risks

The main risks facing EMR at the moment are related to the general slowness of the economic recovery. EMR has been investing a lot in emerging markets, but unless the economy as a whole shrugs off it’s anemic growth it will take a while for these investments to see the kinds of returns that they are capable of. Furthermore, if we get caught in a new recession it’s reasonable to expect EMR’s revenue to drop as the kinds of large scale industrial equipment that they make are some of the first things to be cut back on as business conditions worsen.

EMR Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for EMR is $30.45. The stock price is higher than the Graham number, suggesting that EMR may be overvalued valued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 1.36, the CAPM model provides a discount rate of 20.9%. Using a growth rate of 15% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $18.57, suggesting that EMR is overvalued. I also tried this model with a discount rate of 10% and got $84.08, suggesting that EMR is undervalued.

One Stage (Gordon Growth) Dividend Discount Model

Using a growth rate of 10% and the 20.9% discount rate, the one stage model produces a value of $16.58, suggesting EMR is overvalued.

Valuation Conclusion

Of the different models tested, EMR ranks as overvalued on 3 out of 4.

EMR Cash Secured Puts

I feel that EMR is currently overvalued and thus won’t recommend initiating a position in the stock at present and wouldn’t recommend selling puts against it either.

Conclusions

I like EMR as a company, but it is current over valued by way of PE ratio and my valuation panel. If the price drops or the valuation otherwise improves, I wouldn’t mind initiating a position in EMR.

Disclosure: Nothing to disclose.

Readers: What are your opinions about Emerson Electric?

Filed under: Stock Analysis · Tags: emerson electric, emr, stock analysis

I like EMR but as you mentioned they are very heavily tied to the global economy. The products they offer are usually the first thing to go whenever business takes a turn for the worse, like most industrials. I don’t think we’ll see 15% growth but a solid 7-9% for the next 10-20 years is just fine with me.

I think that the recent 15% dividend growth was probably a one-shot thing. It’s probably wishful thinking, but if the economic recovery would ever get moving at a reasonable clip, EMR might be able to grow its dividends a bit faster than 8% or so.

Would gladly take 7+% return on this one over next 20 years

Big fan of EMR. Hold just over 100 shares and bought in when most shares about $42.

Too pricy now.

Great analysis.

Mark

Nice pick up. EMR is one of those stocks that I wish I would have picked up a few years ago when it was cheaper and had a higher starting yield.

MFIJ,

Good analysis here.

I like EMR, and am long. However, the last time I purchased shares they were priced around $45. I think $50 would be a good time to initiate a position or add to it.

I think EMR is one of the better long-term industrial holdings available. UTX and ITW are also pretty solid, and I’m a fan of GE as well.

Best wishes!

I’m waiting for EMR to hit a more reasonable valuation, then I’ll probably decide to pick up some shares. It’s one of those companies that I really like but seems to be chronically overvalued.

Hey there, I just wanted to let you know I nominated you for a Liebster Award! http://pretired.org/my-story/wow-two-liebster-award-nominations/

Why thank you. I’ve never heard of the Liebster Award before. I suppose this means that I have to come up with some questions and answers in the near future.

I think EMR seems to be overvalued BECAUSE it’s been such an awesome stock for so many investors. This is always the struggle…you want to buy shareholder friendly companies like EMR, but when is the right time to buy?

EMR has been good to share holders. But the market is pretty irrational so some of EMR’s gains are due to speculation rather than fundamentals. At some point the speculators will run in favor of something else since they have short attention spans and EMR’s price will approach fair value or even drop below fair value. That’s when I’d try to buy.

I like EMR and as the global economy continues to improve I think EMR will continually look better and better. Emerson has a dividend growth streak over 50 years. I think for dividend growth investors, it doesn’t get much better than that. Clearly management knows what they are doing and I don’t think they’ll want to jeopardize a great streak like that. This dividend should continue to rise.

I think EMR will probably continue to be a great company. I just want the price to drop a bit so that I can pick it up at around fair value with a starting dividend yield closer to 3%.