My Financial Independence Journey » Stock Analysis » Chevron (CVX) Dividend Stock Analysis

Chevron (CVX) Dividend Stock Analysis

Chevron (CVX) is the second largest US oil company and the fifth largest oil company in the world. Chevron is involved in the extraction, refinement and marketing of oil and natural gas. The company is divided into two main business units. The first is upstream production, which consists of exploration and production of oil and natural gash and accounts for approximately 27% of 2012 revenue. The second is downstream production, which consists of refining, marketing and transporting oil and natural gash. Downstream production accounts for approximately 72% of revenue. Chevron currently owns 8 refineries and has ownership interests in an additional 6.

Chevron (CVX) is the second largest US oil company and the fifth largest oil company in the world. Chevron is involved in the extraction, refinement and marketing of oil and natural gas. The company is divided into two main business units. The first is upstream production, which consists of exploration and production of oil and natural gash and accounts for approximately 27% of 2012 revenue. The second is downstream production, which consists of refining, marketing and transporting oil and natural gash. Downstream production accounts for approximately 72% of revenue. Chevron currently owns 8 refineries and has ownership interests in an additional 6.

CVX Basic Company Stats

- Ticker Symbol: CVX

- PE Ratio: 9.17

- Yield: 3.3%

- % above 52 week low: 99%

- Beta: 1.18

- Market cap: $235.69 B

- Website: www.chevron.com

CVX vs the S&P500 over 10 years

CVX has been crushing the S&P500. After 10 years, an investment in the S&P500 would have grown by 78% compared to the 283% that an equivalent investment in Safeway would have grown. Strong work CVX, strong work.

CVX has been crushing the S&P500. After 10 years, an investment in the S&P500 would have grown by 78% compared to the 283% that an equivalent investment in Safeway would have grown. Strong work CVX, strong work.

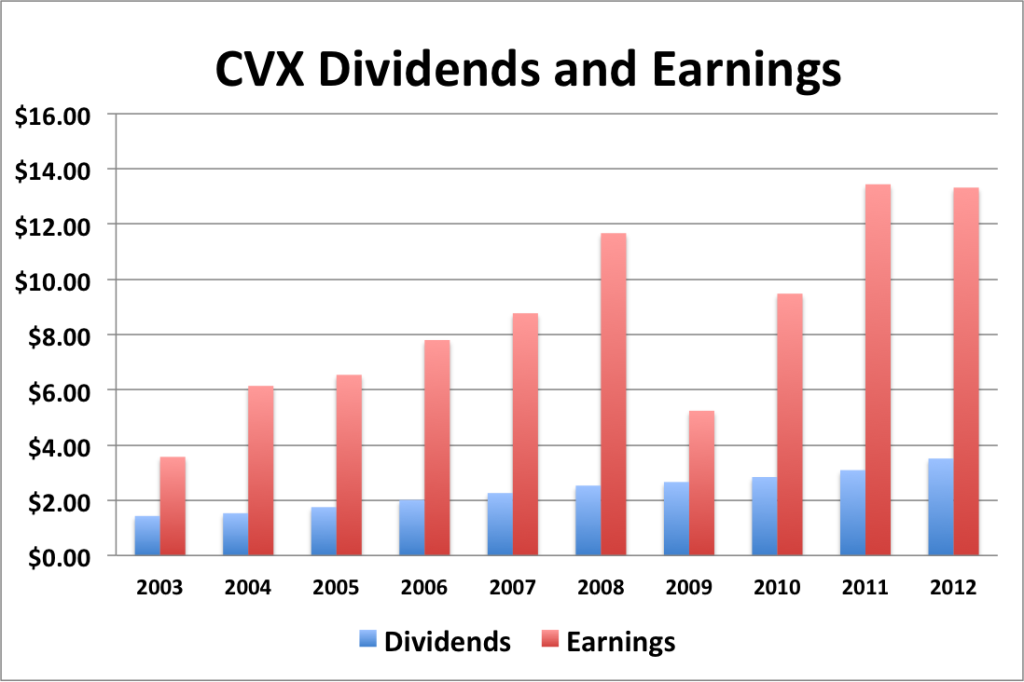

CVX Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: -0.9%

- 3 year EPS growth: 18.5%

- 5 year EPS growth: 3.4%

- 10 year EPS growth: 15.8%

EPS growth for CVX has been pretty solid over the last 10 years with some exceptions. The most obvious one is 2009, during the Great Recession. The less obvious one is 2012, where EPS actually slipped a bit compared to 2011. I’m not too worried a this point, but hope that EPS will resume solid growth in 2013.

- 1 year dividend growth: 13.6%

- 3 year dividend growth: 11.2%

- 5 year dividend growth: 8.5%

- 10 year dividend growth: 10.5%

Dividend growth for CVX has been moving at a nice clip of 10% or so over the last 10 years. Judging from the last 5 years of dividend growth, it’s possible that CVX’s dividends are entering an accelerated growth stage. CVX certainly has a low enough payout ratio to pull that off (see below).

With a starting yield of 3.3% and a growth rate of about 10%, CVX’s yield on cost will grow to well in excess of 9% in 10 years. In order to double the dividend, using the rule of 72, it will take approximately 7.2 years.

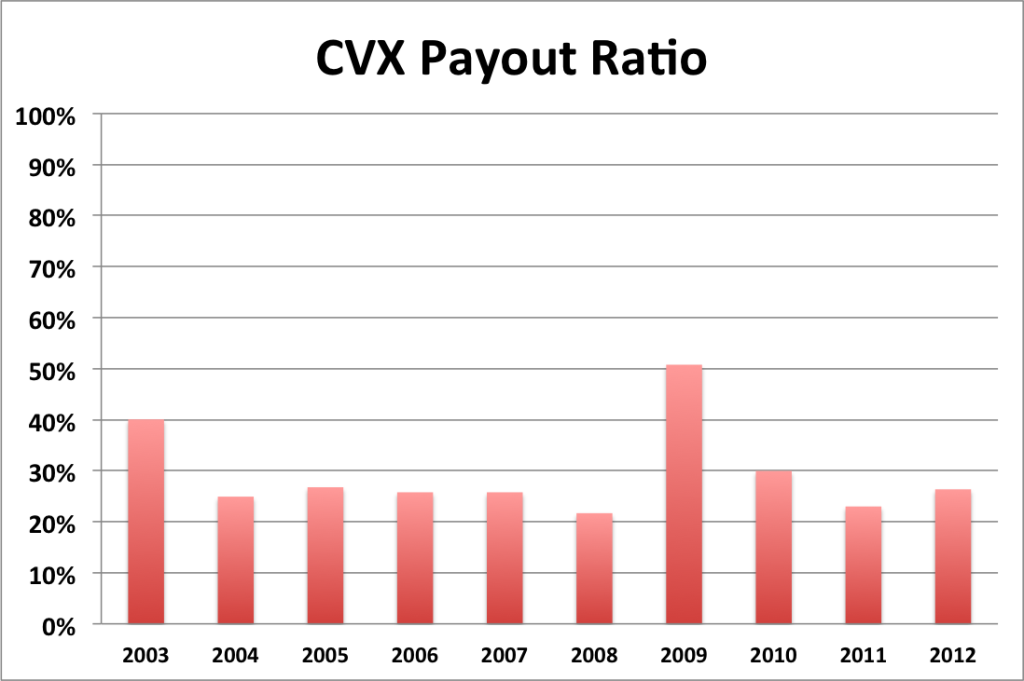

CVX Payout Ratio

CVX’s payout ratio has been crazy low, staying below 30% for most the last decade. Even during the Great Recession in 2009, the payout ratio just barely broke 50%. The average payout ratio over the last 10 years has been 30%. I love the low payout ratio as it gives CVX great room to continue growing its dividends.

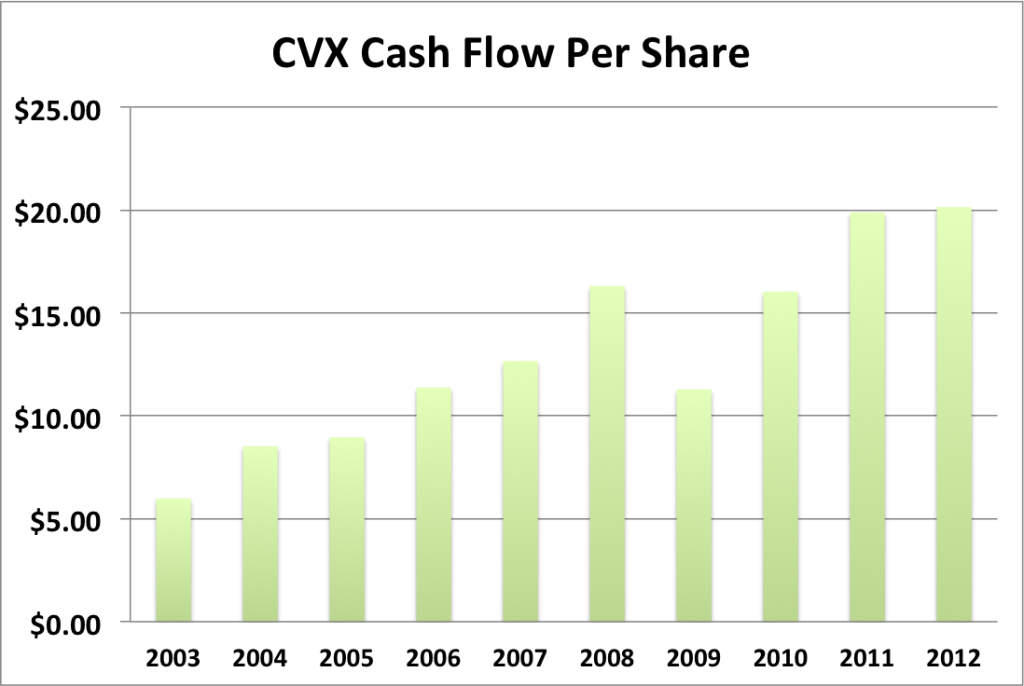

CVX Cash Flow & Revenue Growth

- 1 year revenue growth: -4.6%

- 3 year revenue growth: 8.6%

- 5 year revenue growth: -2.2%

- 10 year revenue growth: 8.1%

CVX’s revenue growth is probably the most disappointing thing about it. I was really hoping to see higher revenue growth from 2011 to 2012. On the other hand, cash flow has been moving in a nicely positive direction.

CVX Balance Sheet

The current debt to equity ratio for CVX about 9%, which is a lot lower than most other equities. The debt to equity ratio has been decreasing over the last ten years. The absolute amount of debt has remained about the same, however the total equity of the company has increased over time, thus driving down the ratio.

CVX Risks

Chevron’s profits are susceptible to the price of oil. Should the price drop again, perhaps during another recession, Chevron’s profits would take a hit.

As an oil company, some amount of environmental damage is going to be a result from Chevron’s activities. As a result, the company is being sued by some government at just about all times. Currently Brazil and Ecuador are suing Chevron. This sounds bad, but I would consider it the cost of doing business in this industry.

Then of course there is the possibility of a big black swan event like the BP deepwater horizon accident. If you recall after the accident, BP temporarily suspended its dividend (now reinstated) and it’s share price dropped and has not yet recovered after nearly 3 years.

CVX Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for CVX is $144.49. The current stock price is below that, suggesting that CVX may be undervalued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 1.18, the CAPM model provides a discount rate of 19.4%. Using a growth rate of 12% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $45.50. I also tried this model with a discount rate of 10% and got $181.23.

Valuation Conclusion

Of the three different models tested, two of the three seem to agree that CVX is very undervalued.

CVX Cash Secured Puts

I really like CVX so I wouldn’t mind selling puts against it at the moment. However, it should be noted that both the market as a whole and CVX are at all time highs, so there is always the possibility of assignment should the market as a whole dip.

Conclusions

Even though CVX is trading at all time highs, I really like the company. The payout ratio and debt load are ridiculously low and the company is currently yielding over 3%. Of course, I’d love to jump in at a lower price, but even at its current price CVX represents one of the only islands of value in the current overheated market.

Disclosure: I am long Chevron and trying to add to my current position.

Readers: What are your opinions about Chevron?

Filed under: Stock Analysis · Tags: chevron, cvx, stock analysis

I also like CVX but selling puts against them is a pretty big risk in my opinion due to the chance of getting executed. For a $100k portfolio you’d be committing 12% of your portfolio just to CVX which seems like a lot of exposure to a company that can have very volatile earnings due to the economic cycle and the price of oil. I’d like to make a purchase between $110 and $113 and unfortunately missed the last opportunity.

Thanks for putting this analysis together. The prospect of investing into Chevron looks great. The growth rate at around 9% and 19 years of increasing dividends is amazing!

I took a position in CVX @121 not that long ago. I don’t feel like it was at the best value point but its a position I expect to hold for 10+ years so hopefully I won’t ever look back.

Great info here. New to me about the Graham number – thanks for sharing, Myfij!

Thanks for the great analysis, I happen to be looking in to both CVX and another stock you reviewed (SWY). Honestly I was already sold on CVX and was ready to buy it but I just missed the ex-div date so I purchased LO instead. I’ll be buying soon though.

Cheers,

CD

Good analysis. I am a long timer reader and have been long CVX for many years. It’s such a stable and consistent dividend grower. I actually just wrote an analysis on CVX. If you want, you can read it. I just had my 2nd article published. Please check it out at http://seekingalpha.com/article/1532612-why-chevron-is-undervalued-right-now

Nice article on CVX. I love how CVX got even more undervalued after I did my own analysis. Not so fond of how it dropped in price right after I bought it. Regardless, I’m almost tempted to increase my holdings in CVX even further, especially if it keeps dropping.