My Financial Independence Journey » Stock Analysis » Safeway (SWY) Dividend Stock Analysis

Safeway (SWY) Dividend Stock Analysis

Safeway (SWY) is one of the largest food and drug retailers (better known as supermarkets) in North America. SWY has about 1700 stores mostly located on the West Coast but also in the Southwest, Chicago and Mid-Atlantic. They even have stores in Canada. In order to support all of these stores, SWY has its own network of distribution, manufacturing, and processing facilities.

Safeway (SWY) is one of the largest food and drug retailers (better known as supermarkets) in North America. SWY has about 1700 stores mostly located on the West Coast but also in the Southwest, Chicago and Mid-Atlantic. They even have stores in Canada. In order to support all of these stores, SWY has its own network of distribution, manufacturing, and processing facilities.

SWY Basic Company Stats

- Ticker Symbol: SWY

- PE Ratio: 9.71

- Yield: 2.5%

- % above 52 week low: 62.7%

- Beta: 1.1

- Market cap: $5.73 B

- Website: www.safeway.com

SWY vs the S&P500 over 10 years

SWY appears to be matching the S&P500. After 10 years an investment in the S&P500 would have grown by 76% compared to the 40% that an equivalent investment in Safeway would have grown. This seems low, but if you look at the graph you can see that SWY tends to both slightly over and slightly under perform the S&P500. So I’m going to call it a tie.

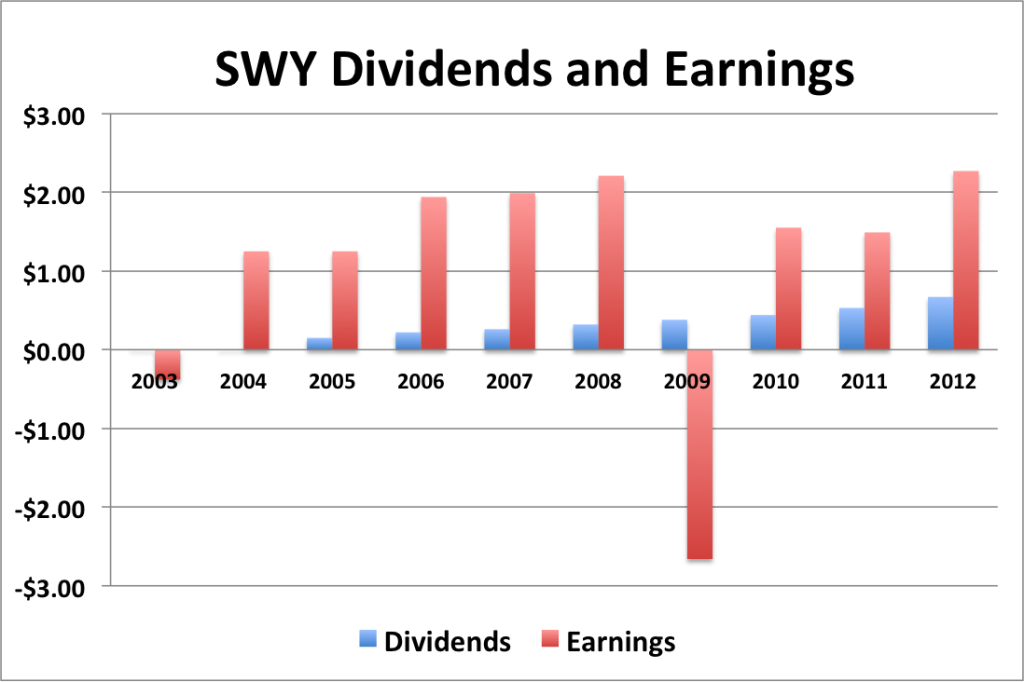

SWY Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: 52.3%

- 3 year EPS growth: 21.0%

- 5 year EPS growth: 0.7%

EPS growth for SWY has been spotty over the last 10 years. It was negative in 2003 and 2009, both of which were recessions, so I can understand. EPS in 2012 finally beat EPS in 2008. And just in case you were wondering, earnings in the first quarter of 2013 was lower than expected. But overall, it looks like EPS has finally returned to pre-Great Recession levels.

- 1 year dividend growth: 26.4%

- 3 year dividend growth: 23.4%

- 5 year dividend growth: 20.3%

Dividend growth for SWY has been on a tear since 2005. Just in case you were wondering, 2005 was the year that SWY started paying dividends in. The 7 year dividend growth rate was 28.3%. It is likely that SWY is in a phase of accelerating dividend growth.

With a starting yield of 2.5% and a growth rate of about 20%, SWY’s yield on cost will grow to well in excess of 12.5% in 10 years. In order to double the dividend, using the rule of 72, it will take approximately 3.5 years.

It’s not clear to me how long SWY will be able to maintain this rate of dividend growth. On the plus side, the payout ratio is low (see below). But if the EPS doesn’t start growing again SWY will have to slow its dividend growth sooner rather than later.

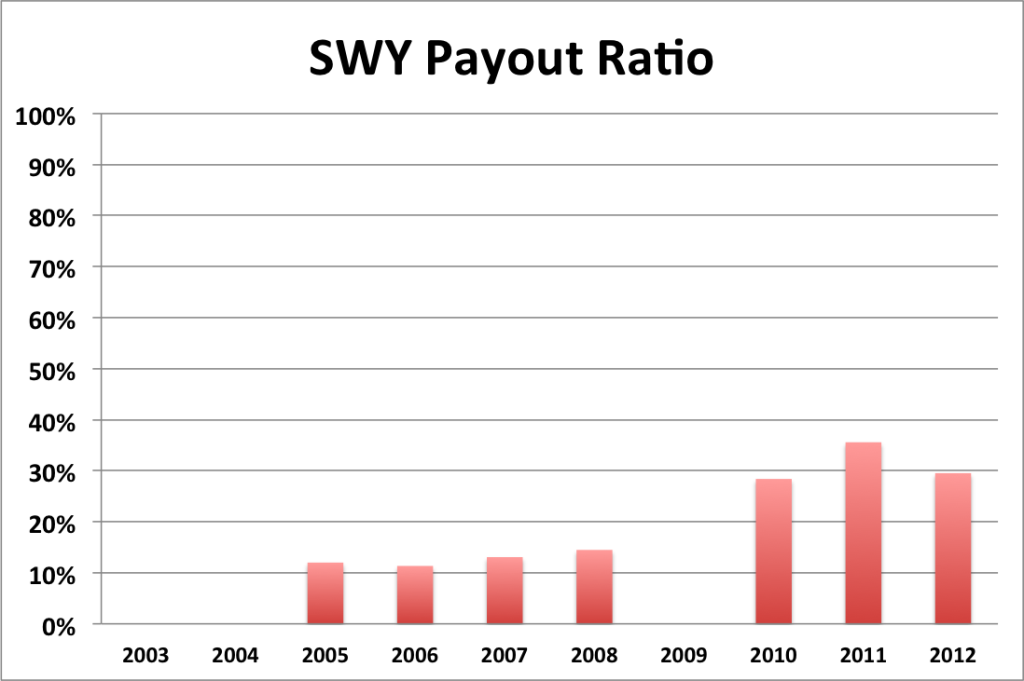

SWY Payout Ratio

Note: Just so that we’re all clear about the chart above, SWY didn’t start paying dividends until 2005. 2009 had a negative EPS, so the payout ratio is meaningless, thus I excluded it from the chart.

SWY’s payout ratio is currently hovering around the 30% range. If SWY continues to increase it’s dividend aggressively without concomitant increases in earnings the payout ratio will have to increase. Given the current dividend growth rate, the question is how high will the management let dividend payout go before it slows down dividend growth. I would guess that dividend growth would slow down around a payout ratio of 50-60%.

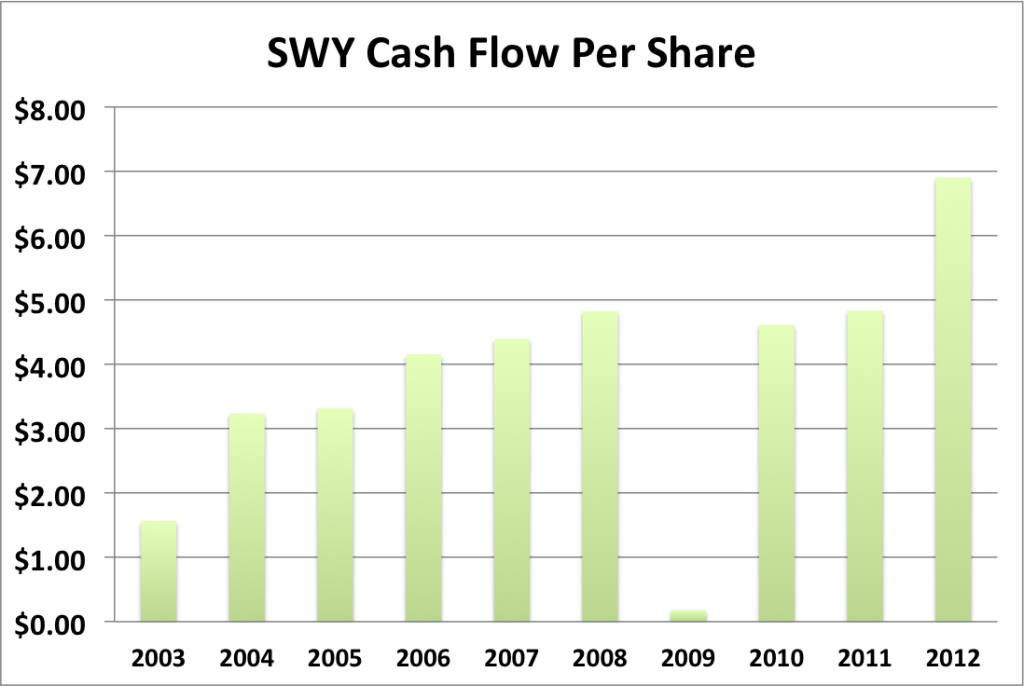

SWY Cash Flow & Revenue Growth

- 1 year revenue growth: 1.3%

- 3 year revenue growth: 3.8%

- 5 year revenue growth: 0.1%

- 10 year revenue growth: 2.5%

SWY’s revenue growth hasn’t exactly been stellar. Admittedly the supermarket business is pretty competitive so this is perhaps to be expected. As for cash flow, SWY has keep up a pretty steady trend of increasing cash flow. But man, they got hit hard in 2009 with the recession.

SWY Balance Sheet

The current debt to equity ratio for SWY about 165%, which is a lot higher than most other equities. SWY has maintained a pretty high debt to equity ratio over the last 10 years, so I would assume that this is standard operating procedure for them. This wouldn’t concern me too much except for the fact that SWY doesn’t appear to be a stellar company by any other metric.

SWY Risks

The supermarket business is a low margin business. Since 2005 SWY has been working to improve it’s stores adding higher quality foods and full service meat counters and bakeries, among other things. So far, these improvements appear to be working but as almost all the stores have finished their upgrades it remains to be seen just how much additional revenue these renovations can bring in.

I expect profit margins to remain narrow as the wholesale price of food continues to increase and as shoppers shift away from traditional supermarkets towards value oriented stores (Wal-Mart and Aldi) and specialty food stores.

But SWY is a large established chain, so I wouldn’t expect it to fold any time soon.

SWY Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for SWY is $25.82. The current stock price is slightly below that, suggesting that SWY may be undervalued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 1.1, the CAPM model provides a discount rate of 18.8%. Using a growth rate of 20% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $10.98. I also tried this model with a discount rate of 10% and got $43.85.

Valuation Conclusion

Of the three different models tested, all seem to agree that SWY is undervalued, with the Graham number model suggesting that SWY is more fairly valued than undervalued.

SWY Cash Secured Puts

SWY is likely fair valued or under valued at the moment based on the valuation models and P/E ratio. SWY is also hovering in the upper half of its 52 week range. This could make it a good candidate to sell cash secured puts against. However, the potential profit from put sales must be weighed against the risk of assignment. So you have to think carefully about whether you want to potentially own SWY or not.

Conclusions

Overall, I have mixed feelings on SWY. The valuation models suggest that the company is a good buy. The yield is a bit low for my tastes, but that can be circumvented by put selling or just waiting for a dip in the price. And the opportunity to get in on the ground floor of company with a 20% dividend growth rate is enticing. However, after doing this analysis I’m not exactly in love with SWY. I think that there are better players out there in the supermarket space.

I wouldn’t discourage anyone from buying SWY, but I wouldn’t encourage them either. I’d say but it if you like but don’t plan on making it a large position in your portfolio.

Disclosure: I have nothing to disclose.

Readers: What are your opinions about Safeway?

Filed under: Stock Analysis · Tags: safeway, stock analysis, swy

Thanks for another great, detailed, review. That 20+% dividend growth rate is definitely very intriguing, but that’d be tough to keep up over the long run.

20% is unsustainable in the long-run. But SWY probably has a few more years of heavy dividend growth before they have to start slowing down. The big question is will the dividend growth slow down to a reasonable 7-10% or an anemic 1-4%.

I agree, from my little bit of knowledge about dividend investing. I’d buy a bit, but not too much.

Today SWY increased its dividend, so I took a look at SWY and came up to similar conclusions. The dividend increase is a good sign tome, so I am definitely on a buy side of the game with this stock.

Growing up I never went to Safeway. It wasn’t any good where I lived so we always went to Krogers. In SF there are Safeway’s everywhere. Their produce is nice it’s just expensive. I like going to Trader Joe’s more but it’s not as convenient and the produce there is just not as fresh.

Great analysis. For me, any analysis of dividend stocks must include an analysis of the entire industry. I personally think the biggest problem with grocery stores is that their profit margin is too small, meaning that if there’s even a small amount of mismanagement in inventories, things can go south real quick.