My Financial Independence Journey » Stock Analysis » General Electric (GE) Dividend Stock Analysis

General Electric (GE) Dividend Stock Analysis

General Electric (GE) is a conglomerate that products ranging from jet engines and gas turbines to consumer appliances, railroad locomotives and medical equipment. Additionally, GE is also a major provider of consumer and commercial financing. This part is important because it gets GE into a lot of trouble in 2008. GE does business through eight segments: Power &Water (19% of sales), Oil & Gas (10%), Energy Management (5%), Aviation (14%), Healthcare (12%), Transportation (4%), Home & Business Solutions (5%), and GE Capital – the segment involved in financing (31%). GE had to cut it’s dividend in 2009 because of the financial crisis. GE Capital had grown so large, accounting for around 50% of earnings, that when the GE was for all intents and purposes a bank. Predictably, what happened to most banks (dividend cuts) happened to GE as well. Since then, GE has been trying to turn itself around. It has sold off its holdings of NBC (the TV network), reduced the size of GE Capital, and raised its dividend several times.

General Electric (GE) is a conglomerate that products ranging from jet engines and gas turbines to consumer appliances, railroad locomotives and medical equipment. Additionally, GE is also a major provider of consumer and commercial financing. This part is important because it gets GE into a lot of trouble in 2008. GE does business through eight segments: Power &Water (19% of sales), Oil & Gas (10%), Energy Management (5%), Aviation (14%), Healthcare (12%), Transportation (4%), Home & Business Solutions (5%), and GE Capital – the segment involved in financing (31%). GE had to cut it’s dividend in 2009 because of the financial crisis. GE Capital had grown so large, accounting for around 50% of earnings, that when the GE was for all intents and purposes a bank. Predictably, what happened to most banks (dividend cuts) happened to GE as well. Since then, GE has been trying to turn itself around. It has sold off its holdings of NBC (the TV network), reduced the size of GE Capital, and raised its dividend several times.

GE Basic Company Stats

- Ticker Symbol: GE

- PE Ratio: 17.42

- Yield: 3.2%

- % above 52 week low: 87.5%

- Beta: 1.38

- Market cap: $243.2 B

- Website: www.ge.com

GE vs the S&P500 over 10 years

GE has been sadly under performing the S&P500 over the last 10 years. Over that time frame an investment in the S&P500 would have grown by about 64.54% compared to the -23.26% that an equivalent investment in GE would have grown shrunk. For such a major company, the overall stock performance of GE has been sad. Not just post-recession sad, but also pre-recession sad (see the returns up to 2007).

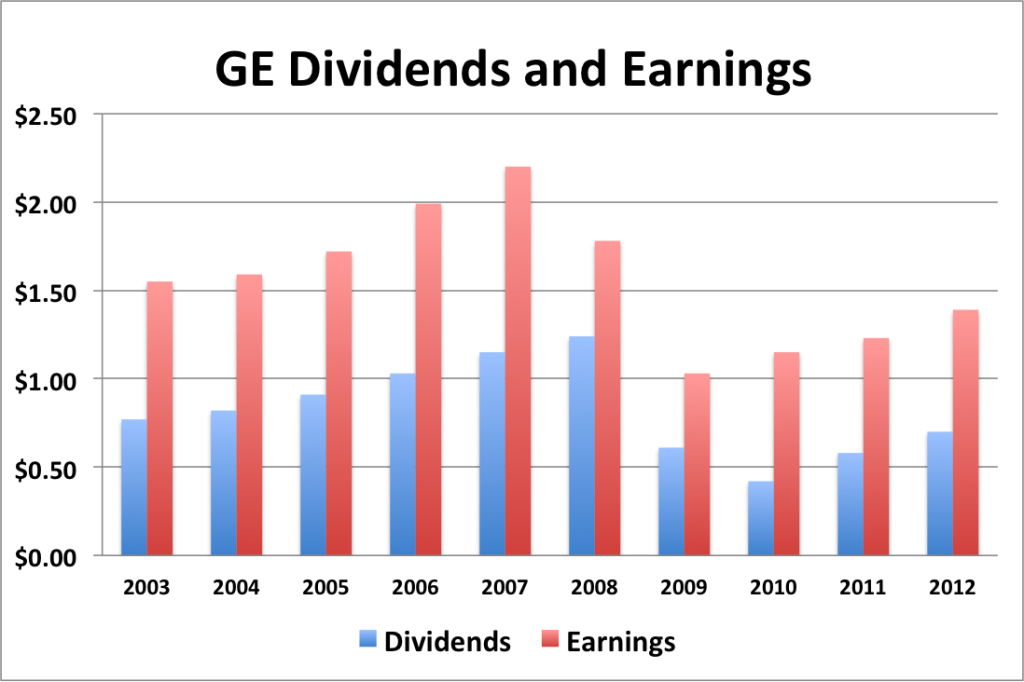

GE Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: 13.0%

- 3 year EPS growth: 9.9%

- 5 year EPS growth: -6.0%

- 10 year EPS growth: -1.2%

EPS growth for GE was generally upwards until 2008 when it started falling due to the recession. In 2010, EPS growth continued it’s upward growth trend.

- 1 year dividend growth: 20.7%

- 3 year dividend growth: 29.1%

- 5 year dividend growth: -13.3%

- 10 year dividend growth: -1.1%

Dividend growth for GE was spectacular up until 2008. In 2009 and 2010 GE had to cut its dividend due to major losses from the Great Recession. From 2011 onwards GE has been raising it’s dividend. In the long term, I suspect that GE will try to continue to raise it’s dividend in order to get it back to pre-Recession levels.

With a starting yield of 3.2% and a growth rate of about 10%, GE’s yield on cost will grow to well in excess of 7.8% in 10 years (assuming it can keep up the current clip of dividend growth). In order to double the dividend, using the rule of 72, it will take less than 7.2 years.

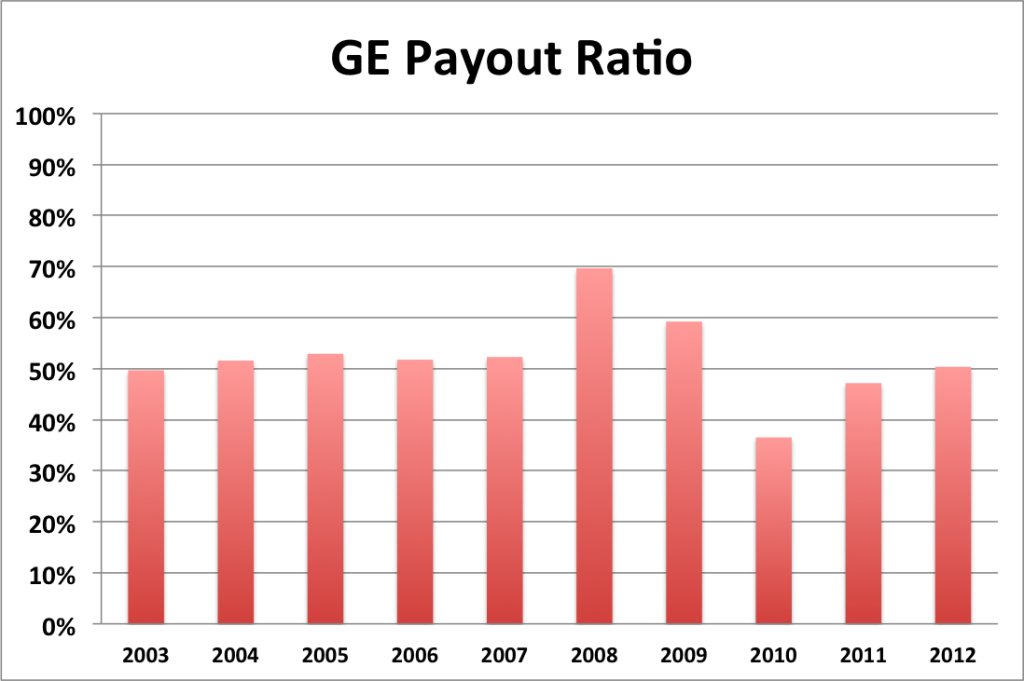

GE Payout Ratio

GE’s payout ratio has been generally hovering in the 50% range. 2008-2010 are notable exceptions thanks to the effects of the Great Recession and the dividend cuts. By 2012 it appears that the payout ratio has once again returned to normal.

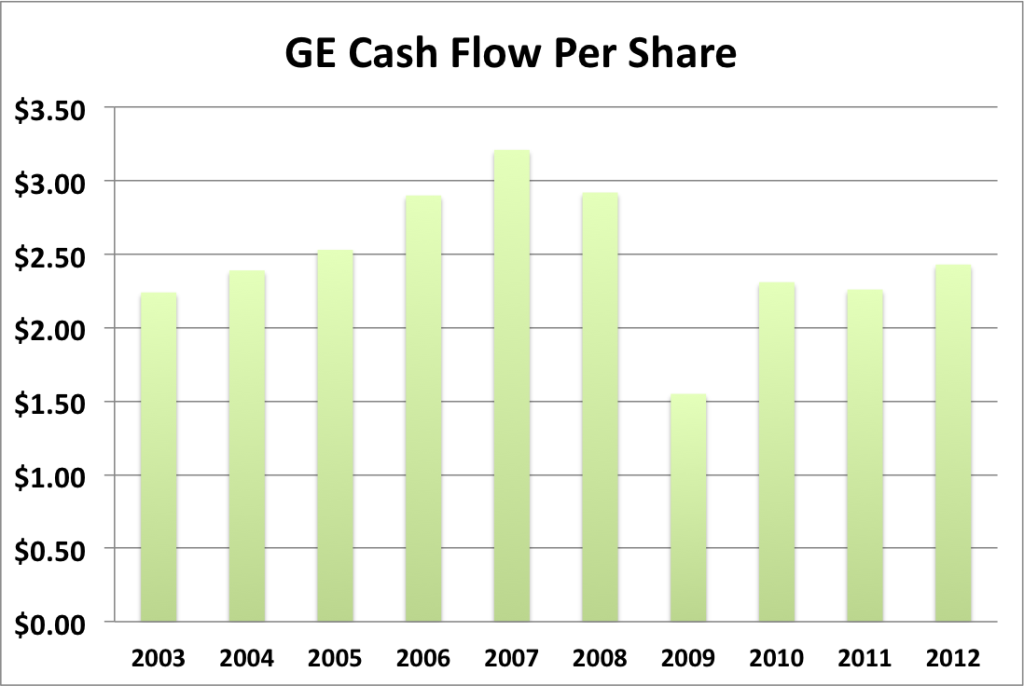

GE Cash Flow & Revenue Growth

- 1 year revenue growth: 0%

- 3 year revenue growth: -1.0%

- 5 year revenue growth: -5.2%

- 10 year revenue growth: 1.0%

GE’s cash flow has generally mirrored it’s EPS, dipping in 2009 and being rather flat from 2010 to 2012. More disturbing has been the revenue growth, or should I say lack thereof. It’s wrong to say that revenue has been increasing in the last 3 years and more accurate to say that the rate of revenue loss has been slowing. I suspect that revenue will turn around soon and start to show positive growth.

GE Balance Sheet

The current debt to equity ratio for GE is about 192%. GE has always had high debt to equity level and at around 200% it appears to be returning to normal pre-recession levels. During the recession, the debt to equity levels shot up to 300-400%

GE Risks

The main risks facing GE at the moment involve low economic demand particularly from Europe as the economic recovery is sluggish at best. The problems associated with GE Capital appear to be largely past us and assuming that GE continues to decrease the size of this business segment, the more stable GE will be when the next recession hits.

GE Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for GE is $19.06. The stock price is higher than the Graham number, suggesting that GE may be overvalued valued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 1.38, the CAPM model provides a discount rate of 21.0%. Using a growth rate of 20% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $10.01, suggesting that GE is overvalued. I also tried this model with a discount rate of 10% and got $47.61, suggesting that GE is undervalued.

Valuation Conclusion

Of the different models tested, GE produces valuation numbers all over the charts. My gut feeling is that GE is probably just over fair valued at the moment.

GE Cash Secured Puts

While I don’t feel that GE is in cash secured put territory at the moment, the stock price is pretty low (low $20s) so put options could be a great way to enter into the stock if you have enough money for a full lot.

Conclusions

I like GE as a company and think that it is on its way to recovery after the big hit it took during the Great Recession. Before the recession, GE was a dividend powerhouse and it looks like the management wants to regain that status. But I’m not convinced that right now is the best time to jump on GE. If recent market volatility knocks the stock down a bit it might be good to grab up some shares.

Disclosure: Nothing to disclose

Readers: What are your opinions about General Electric?

Filed under: Stock Analysis · Tags: GE, general electric, stock analysis

GE is on my watch list too. I am also waiting for some pull back. Thanks for the sensible analysis.

Thanks for the news.

Basic question, why do you use a risk free rate of 2%?

Also, when does GE receive the cash for the sale of NBC? I think it is late this year or early next year. I would expect a dividend increase as a result.

I use 2% as the risk free rate since that’s about the going rate on the 10 year treasury, generally regarded a “safe investment.” If I remember right the NBC sale will be completed next year.

GE still has a long way to go before I will want to invest with them again. Competition is fierce in their space and they have a lot to overcome with their old school brand in my opinion.

I think that GE is making progress, but not enough to make me want to invest in them right now. If I was going to invest in GE, I should have done it when it was a few dollars cheaper.

Glad to see an analysis on GE. I’ve been meaning to look more into them but just haven’t had the time. My gut feeling was that current prices weren’t necessarily great values but there isn’t much in the market that is a screaming buy.

I was curious to see how much GE capital brought in and I hope they continue to shrink it’s relative size. 31% is still a little high for my liking considering that segment almost single-handedly brought down the company.

I think GE still has a lot of reorganization to do, especially reducing the size of GE capital. It will be interesting to see how a continued reduction in GE capital affects the company’s overall earnings.

I bought some GE shares quite awhile back at a great price. I think long term the company will turn out to be a pretty good investment. But, with that being said, I’d probably be looking for a lower current price. For some reason, due to the fact that they had to cut their dividend rate back in the financial crisis, I’m still a hesitent to own the company unless I can get a fantastic price (like I did a couple years ago). However, I think they’ve worked through alot of their problems and risks and are becomming a stronger company as each day passes going forward.

I agree that GE has worked through most of its problems. It’s a better buy at the moment than I’m giving it credit for. But I can’t shake the thought that it just hasn’t recovered enough since it’s rather devastating dividend cut. I wish I would have picked GE up when it was trading in the $19-20 range.