My Financial Independence Journey » Stock Analysis » Exxon Mobil (XOM) Dividend Stock Analysis

Exxon Mobil (XOM) Dividend Stock Analysis

Exxon Mobil (XOM) is a the largest publicly traded oil company in the world, operating in over 200 countries. It has three major business segments. One, oil and natural gas exploration and production (64% of earnings). Two, refining and marketing (28%). Three, chemical manufacture and distribution (8%). XOM is also involved in a number of other smaller operations such as coal mining and electric power generation. Exxon owns 32 refineries mostly spread across North America, Europe, and Asia. And it maintains the largest proven reserves in North America and is the leading producer of oil and natural gas in Europe.

Exxon Mobil (XOM) is a the largest publicly traded oil company in the world, operating in over 200 countries. It has three major business segments. One, oil and natural gas exploration and production (64% of earnings). Two, refining and marketing (28%). Three, chemical manufacture and distribution (8%). XOM is also involved in a number of other smaller operations such as coal mining and electric power generation. Exxon owns 32 refineries mostly spread across North America, Europe, and Asia. And it maintains the largest proven reserves in North America and is the leading producer of oil and natural gas in Europe.

XOM Basic Company Stats

- Ticker Symbol: XOM

- PE Ratio: 9.2

- Yield: 2.80%

- % above 52 week low: 80.7%

- Beta: 0.8

- Market cap: $402.26 B

- Website: www.exxonmobil.com

XOM vs the S&P500 over 10 years

XOM has been consistently outperforming the S&P500 over the last 10 years. Over that time frame an investment in the S&P500 would have grown by about 70% compared to the 150% hat an equivalent investment in XOM would have grown.

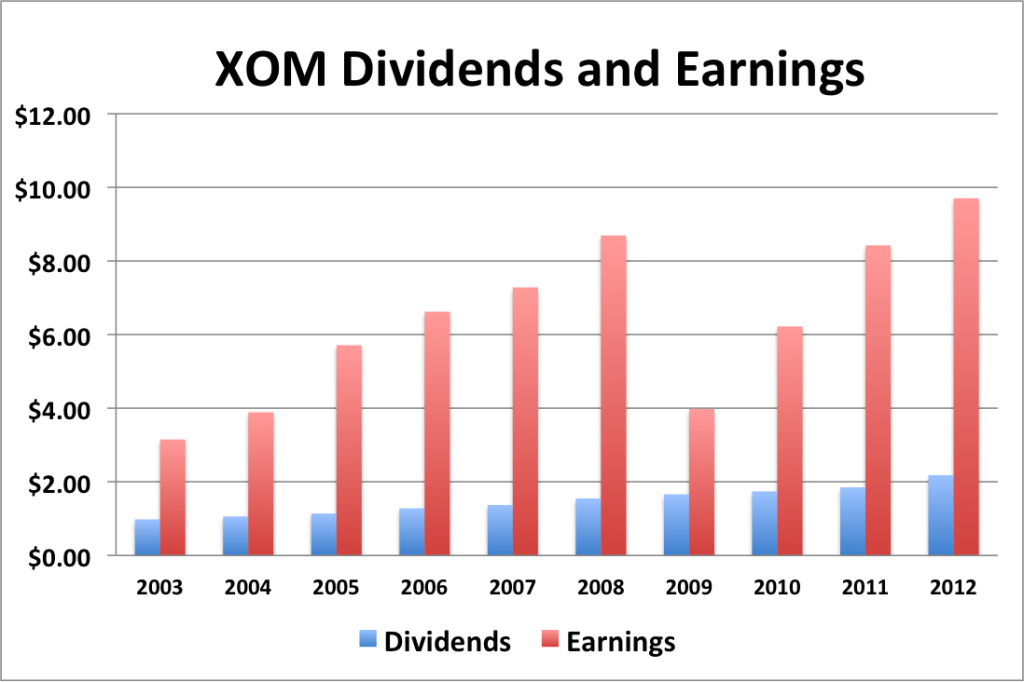

XOM Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: 15.2%

- 3 year EPS growth: 24.9%

- 5 year EPS growth: 2.8%

- 10 year EPS growth: 13.3%

EPS growth for XOM has been very consistent over the last decade. EPS took a hit in 2009 due to the Recession, but then went right back on increasing.

- 1 year dividend growth: 17.8%

- 3 year dividend growth: 11.9%

- 5 year dividend growth: 8.9%

- 10 year dividend growth: 9.3%

Dividend growth for XOM has been averaging around 10% over the last 10 years, and may even be accelerating. Given how low the payout ratio is (see below), I’d say that there is still considerable room for aggressive or even highly aggressive dividend growth for quite some time.

With a starting yield of 2.8 and a growth rate of about 17%, XOM’s yield on cost will grow to well in excess of 15% in 10 years (assuming it can keep up the current clip of dividend growth). In order to double the dividend, using the rule of 72, it will take approximately 3.6 years.

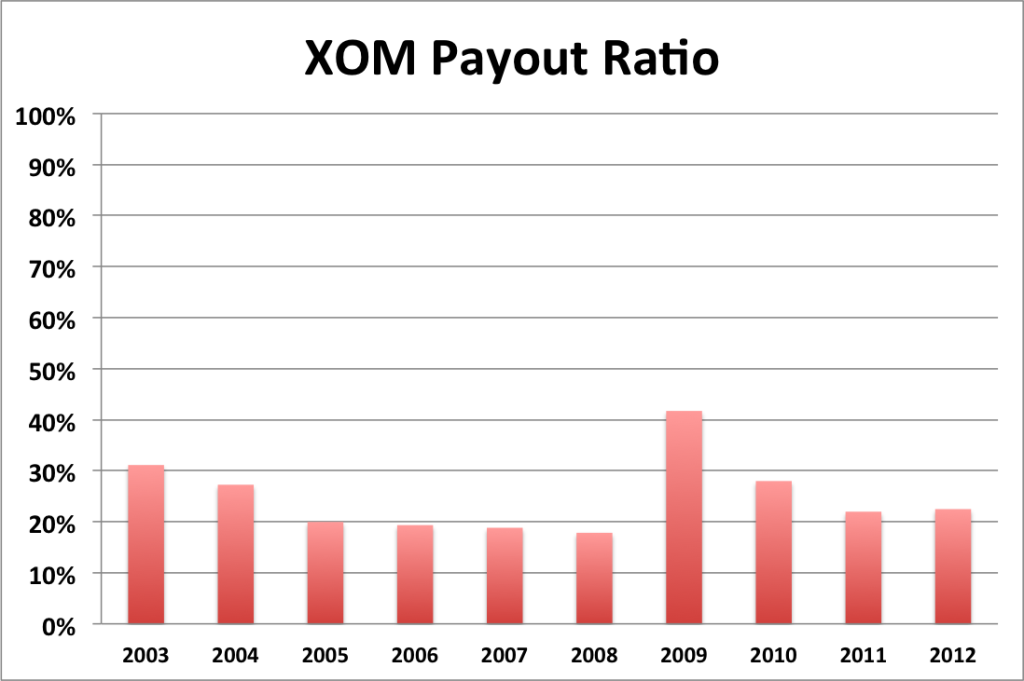

XOM Payout Ratio

XOM’s payout ratio has been very low for such a mature company. Other than 2009, the payout ratio has been 31% or lower. Even in 2009, the payout ratio only hit 42%. The average payout ratio for the last 10 years has been about 25%. By eyeballing the graph above, it appears that XOM wants to keep it’s payout ratio around 25% or below. The fact that XOM has been able to keep the payout ratio low while supporting pretty aggressive dividend increases over the last decade is a testament to how solid this company is.

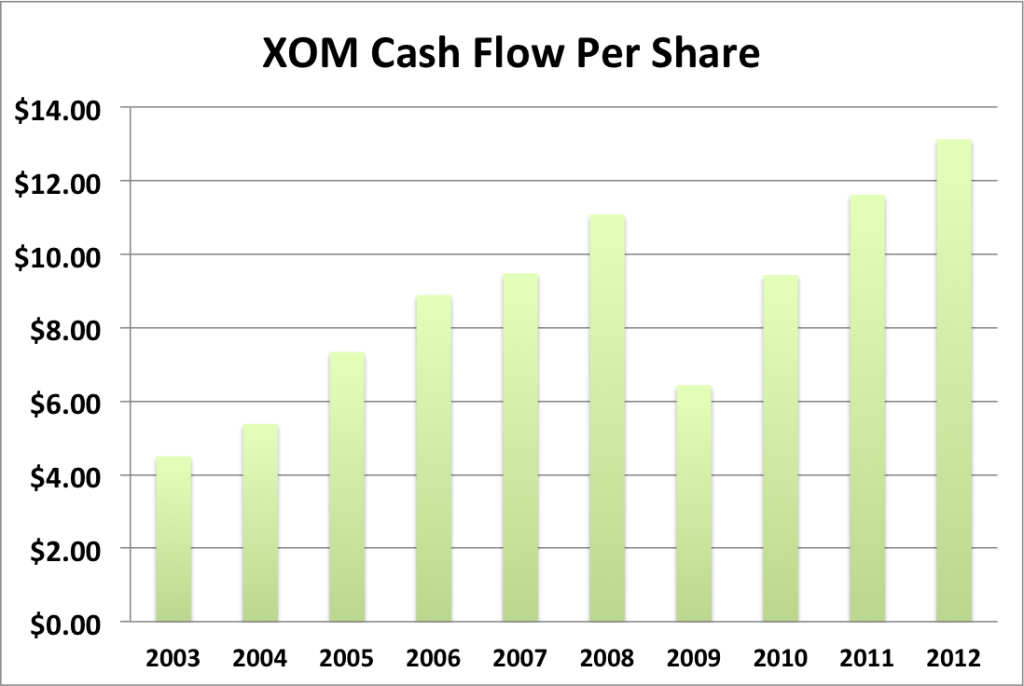

XOM Cash Flow & Revenue Growth

- 1 year revenue growth: -0.8%

- 3 year revenue growth: 12.2%

- 5 year revenue growth: 0.3%

- 10 year revenue growth: 7.7%

XOM’s revenue growth and cash flow growth have essentially mirrored it’s EPS growth. In all cases it has taken a few years to return to 2008 levels, but that’s to be expected given the size of the decrease seen in 2009. As the economy continues to improve, XOM’s cash flow should improve as well.

XOM Balance Sheet

The current debt to equity ratio for XOM is about 5% and has been consistently low over the last 10 years. This is far lower than most companies.

XOM Risks

Exxon Mobil’s profits are susceptible to the price of oil. Should the price drop again, perhaps during another recession, Exxon’s profits would take a hit.

As an oil company, some amount of environmental damage is going to be a result from Exon’s activities. As a result, the company is being sued by some government at just about all times. This sounds bad, but I consider it the cost of doing business in this industry.

Then of course there is the possibility of a big black swan event like the BP deepwater horizon accident. If you recall after the accident, BP temporarily suspended its dividend (now reinstated) and it’s share price dropped and has not yet recovered after nearly 3 years.

Overall Exxon isn’t currently facing any different risks than any other major oil company.

XOM Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for XOM is $91.14. The stock price is almost on par with the Graham number, suggesting that XOM may be fair valued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 0.8, the CAPM model provides a discount rate of 16.4%. Using a growth rate of 15% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $41.67, suggesting that XOM is overvalued. I also tried this model with a discount rate of 10% and got $129.20, suggesting that XOM is undervalued.

One Stage (Gordon Growth) Dividend Discount Model

Using a growth rate of 15% and the 16.4% discount rate, the one stage model produces a value of $207.00. Using a more conservative 10% growth rate, the one stage model produces a value of $43.13.

Valuation Conclusion

Of the five different models tested, XOM appears fair valued at the moment.

XOM Cash Secured Puts

While I don’t feel that XOM is quite in cash secured put territory at the moment, it may be wise to consider selling puts against XOM if the price drops a bit more.

Conclusions

Overall, I like XOM. The starting dividend yield tends to be on the low side, so I am inclined to wait it out until it reaches around a 2.75% starting yield or above. If the price of XOM drops below the midpoint between the 52 week high and low, I will also consider selling a cash secured put against it.

Disclosure: Nothing to disclose

Readers: What are your opinions about Exxon Mobil?

Filed under: Stock Analysis · Tags: exxon, exxon mobil, stock analysis, xom

Nice, thorough, analysis. If I had the money to invest in individual stocks I would consider Exxon just based on it’s long track record. Plus, it can kind of be used as a hedge against rising consumer gas prices.

Great analysis MFIJ. I would consider XOM if it had somewhat of a pullback like you mentioned. It really is a popular holding for those that invest for dividends and that track record vs. the S & P is hard to beat.

The world needs energy and I don’t see our dependence on fossil fuels going away anytime soon. Too much of our infrastructure is based on it and it would be a huge undertaking to try and reverse that. So why not participate in rising energy costs by being a part owner in one of the best. The low starting yield is what keeps me from owning. I’d love to see a 2.80%+ yield. Another dip below $90 and I’m pretty sure I’ll be picking up some shares.

Thanks for the analysis.

XOM is a solid consistent play. I’m a little averse to commodity dividend payers in general, but given the dwindling state of oil resources and increasing marginal cost of extraction. Oil is one commodity I am happy to have exposure to. Unfortunately I’ve got significant exposure to BP at the moment, so I’m good with my oil related exposure at the point.

Love XOM and CVX for the same reason: cash machines!

From time to time we read an article about the price of oil surging to $200 to dropping to $15 depending on which site the writer is. The truth is that we will need fuel for a while and those companies are there to provide it. Definitely a keeper!

Great analysis, I would like to own Exxon at the right price. I did hear that some analysts believe they overpaid for their acquisition XTO a couple years ago.

I would be very cautious with the energy companies. These have been enjoying extremely favourable oil prices for number of years now.

I think the dividends raise has been good for a long time investor, perhaps. For a new comer the yield would be only 2.8%. Which is quite dear I am afraid.

I did analysis of all the big oil companies

( http://www.niterainbow.com/2013/04/energy-stocks-screening.html ) and in comparison ExxonMobil looks somewhat overpriced, should we look as Shell or Gazprom. These two companies could easily give 4-5% yield.

Payout ratio for energy companies is always quite low, as they are very capital intensive. For what ever reason investors like XOM, but I think it is overpriced, in comparison with the other players.