My Financial Independence Journey » Stock Analysis » Thomson Reuters (TRI) Dividend Stock Analysis

Thomson Reuters (TRI) Dividend Stock Analysis

Thomson Reuters (TRI) is massive publishing company. It was formed in 2008 when Thomson acquired Reuters. Currently, TRI has four business segments, Financial & Risk (56% of 2012 revenues), Legal (27%), Tax & Accounting (9%), and Intellectual Property & Science (7%). Geographically, revenues in 2011came from the Americas (58%), Europe, the Middle East and Africa (30%), and Asia (12%). In 2012, about 86% of revenues were recurring, which makes sense given that much of the information that TRI publishes is disseminated via a subscription model. Approximately 90% of 2012 revenue came from electronically delivered products.

Thomson Reuters (TRI) is massive publishing company. It was formed in 2008 when Thomson acquired Reuters. Currently, TRI has four business segments, Financial & Risk (56% of 2012 revenues), Legal (27%), Tax & Accounting (9%), and Intellectual Property & Science (7%). Geographically, revenues in 2011came from the Americas (58%), Europe, the Middle East and Africa (30%), and Asia (12%). In 2012, about 86% of revenues were recurring, which makes sense given that much of the information that TRI publishes is disseminated via a subscription model. Approximately 90% of 2012 revenue came from electronically delivered products.

TRI Basic Company Stats

- Ticker Symbol: TRI

- PE Ratio: 16.39

- Yield: 3.8%

- % above 52 week low: 89.8%

- Beta: 1.17

- Market cap: $28.62 B

- Website: www.thomsonreuters.com

TRI vs the S&P500 over 10 years

TRI was roughly paralleling the S&P500 until 2011 when it started to significantly underperform it. Over the last 10 years, an investment in TRI would have grown by 18% compared to the 70% that an investment in the S&P500 would have grown, which isn’t particularly impressive.

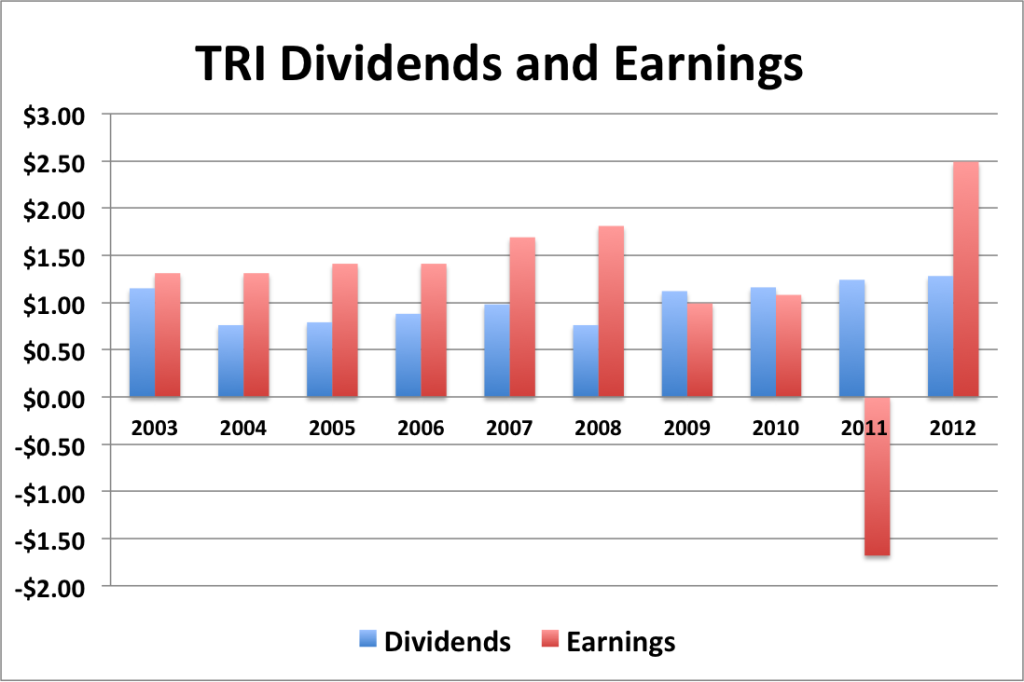

TRI Earnings Per Share (EPS) & Dividend Growth

- 3 year EPS growth: 51.8%

- 5 year EPS growth: 8.3%

- 10 year EPS growth: 7.4%

EPS growth for TRI has not been particularly robust, with dips during 2009 and 2010, and negative earnings in 2011. 2012 has seen earnings return to a more reasonable level. Between 2003 and 2008, EPS did appear to be gradually rising over time. Overall, the earnings data does not get me that excited.

- 1 year dividend growth: 3.2%

- 3 year dividend growth: 5.0%

- 5 year dividend growth: 13.9%

- 10 year dividend growth: 1.2%

TRI is relatively new to the dividend growth game, with only five years of dividend growth history behind it. Before 2008, TRI appeared to have a history of dividend growth and subsequent cuts. Over the last 5 years, it looks like dividend growth has been decelerating. Although if earnings remain at 2012 levels, there may be additional room for growth.

With a starting yield of 3.8% and a growth rate of about 3.2%, TRI’s yield on cost will grow to well in excess of 5.4% in 10 years. In order to double the dividend, using the rule of 72, it will take less than 22.5 years.

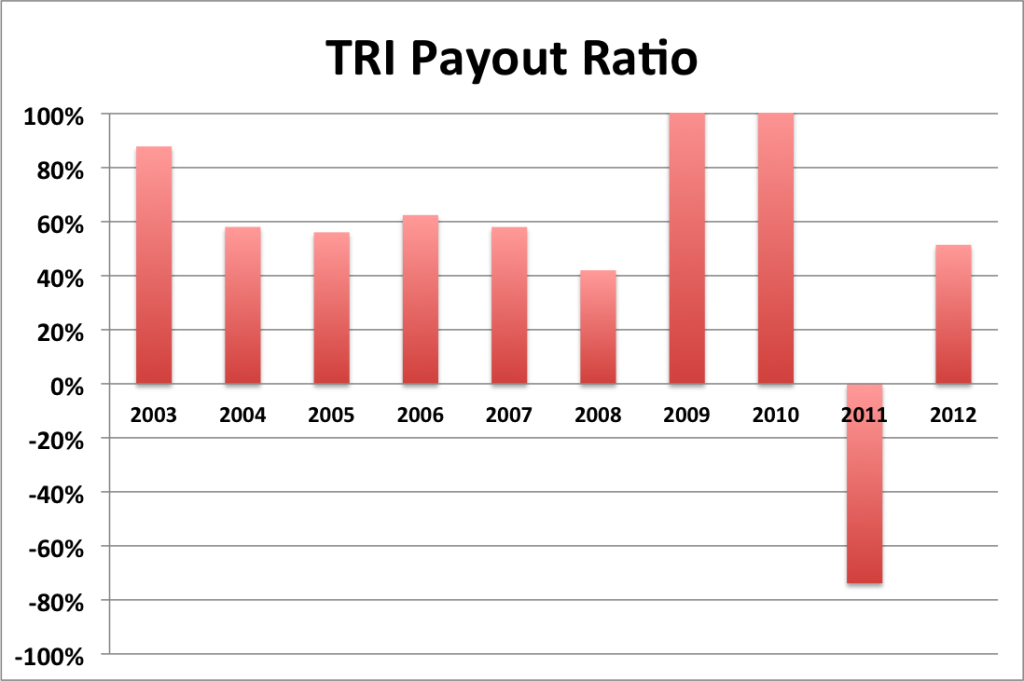

TRI Payout Ratio

TRI’s payout ratio has been high, over 40% for every year. On three of the last 5 years (2009-2011) dividend payouts exceeded earnings.

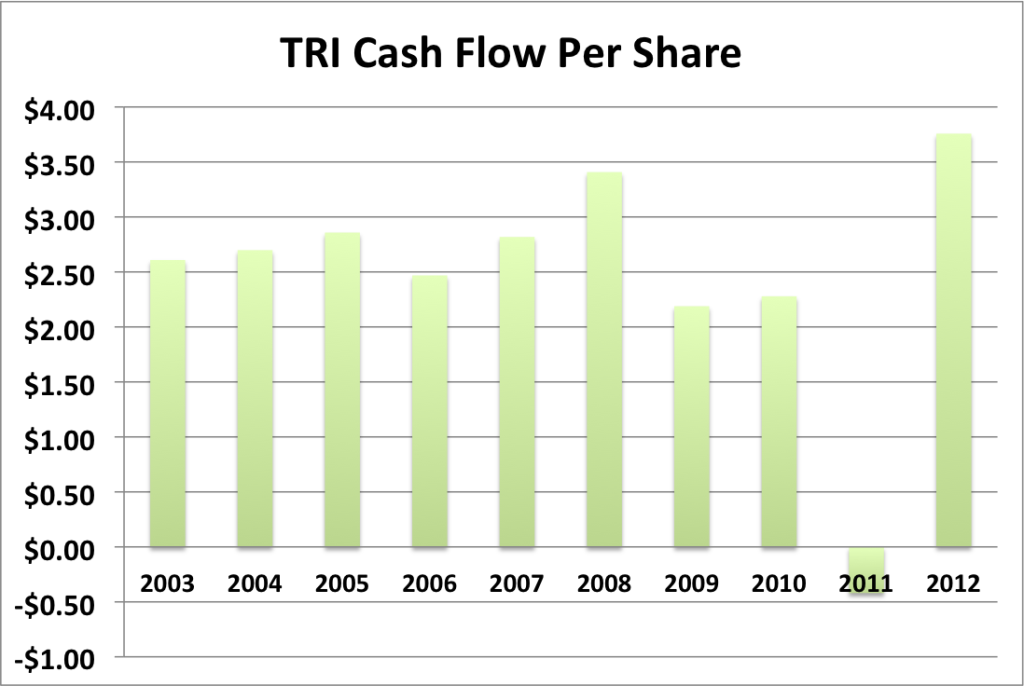

TRI Cash Flow & Revenue Growth

- 1 year revenue growth: -3.8%

- 3 year revenue growth: 0.8%

- 5 year revenue growth: 3.2%

- 10 year revenue growth: 6.4%

Cash flow has not been particularly impressive for TRI either. Generally, I like to see a nice upward trend of cash flow, even if there is a bad year or two. But here we almost have a downward trend until 2011, culminating with negative cash flow. For 2012 cash flow appeared to be better than ever. But the overall decline in revenue over the last 10 years makes me wonder whether 2012 is just going to be a temporary spike.

TRI Balance Sheet

The current debt to equity ratio for TRI is about 37% and has been hovering around that number for the last 10 years.

TRI Risks

You might think that publishing is a field with a pretty small moat. After all, anyone can start up a magazine or start writing a blog. But what TRI publishes are products much different than you’re probably used to interacting with. For example, they publish Westlaw, one of the two major legal research databases. TRI also publishes numerous peer reviewed scientific journals, and business and financial data that competes directly with Bloomberg. These aren’t areas that are easily accessible to anyone with a computer.

The overall health of TRI’s products depends on the health of the underlying industries and the economy as a whole. As industries do better, they’ll need more subscriptions t o the kinds of products that TRI offers.

TRI Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for TRI is $30.94. The stock price is higher than the Graham number, suggesting that TRI may be slightly overvalued valued at the moment.

Two Stage Dividend Discount Model

Given the low level’s of TRI’s dividend growth, I don’t feel that a two stage model is appropriate at this time.

One Stage (Gordon Growth) Dividend Discount Model

Using a growth rate of 5.0% and a 10% discount rate, the one stage model produces a value of $27.30, suggesting that TRI is overvalued.

Valuation Conclusion

Of the two models used, both suggest that TRI is overvalued.

TRI Cash Secured Puts

I’m not inclined to initiate a position in TRI, so I wouldn’t be willing to sell puts against it either.

Conclusions

At present TRI does not appear to be a strong pick for a dividend growth portfolio. It only has 5 years of solid dividend growth, but those same five years are lacking growth in earnings, cash flow, and revenue. If those don’t grow, there is no way that the dividends will continue to grow.

Disclosure: Nothing to disclose.

Readers: What are your opinions about Thomson Reuters?

Filed under: Stock Analysis · Tags: thomson reuters, tri

Nice write up. I wasn’t aware Thomson Reuters even paid a dividend. This was an good business to be in prior to the investment banking meltdown in 2009. Same thing with Bloomberg. As banks went under and they cut whole divisions and consolidated, the number of clients went under and licensing revenue to financial services still hasn’t recovered. I’m surprised 2012 earnings were so high. Any one offs in that number?

From what I can tell, TRI completed a number of divestitures in 2012, so the high earnings could due to money made from those deals.

[…] 10. My Financial Independence Journey doesn’t like Thomson Reuters (TRI). […]