My Financial Independence Journey » Stock Analysis » Proctor and Gamble (PG) Dividend Stock Analysis

Proctor and Gamble (PG) Dividend Stock Analysis

Proctor and Gamble (PG) is a leading company in the manufacture of household and personal care products. The company has five main business segments: beauty (24% of sales) , grooming (10% of sales), health care (15% of sales), fabric and home care (32% of sales), and baby and family care (19% of sales). The company has around 25 commonly recognizable brands including Tide, Gillette, Crest, Dawn, Duracell, Charmin, and Pampers. The US and Canada account for about only 39% of P&G’s total sales and the company is currently undergoing a restructuring plan designed to cut down on overhead and increase profit margins.

Proctor and Gamble (PG) is a leading company in the manufacture of household and personal care products. The company has five main business segments: beauty (24% of sales) , grooming (10% of sales), health care (15% of sales), fabric and home care (32% of sales), and baby and family care (19% of sales). The company has around 25 commonly recognizable brands including Tide, Gillette, Crest, Dawn, Duracell, Charmin, and Pampers. The US and Canada account for about only 39% of P&G’s total sales and the company is currently undergoing a restructuring plan designed to cut down on overhead and increase profit margins.

PG Basic Company Stats

- Ticker Symbol: PG

- PE Ratio: 18.18

- Yield: 2.8%

- % above 52 week low: 97.3%

- Beta: 0.31

- Market cap: $218.75 B

- Website: www.pg.com

PG vs the S&P500 over 10 years

PG seems to be moving on par with the S&P500. After 10 years an investment in PG would have increased by about 80%, compared to about 83% for the S&P500 as a whole. Basically par for course.

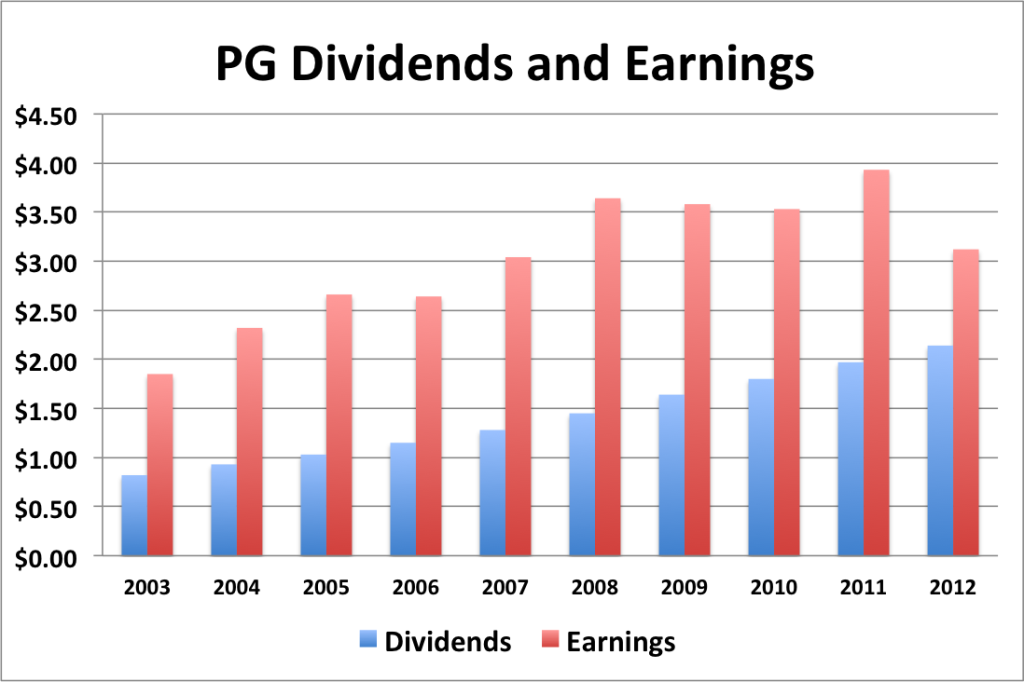

PG Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: -20.6%

- 3 year EPS growth: -6.0%

- 5 year EPS growth: -3.8%

- 10 year EPS growth: 6.0%

EPS growth for PG appears to be flat over the last few years with a dip in 2012. I’m comfortable assuing that the 2012 dip may be transient, but I don’t foresee a substantial upward trend in earnings any time soon.

- 1 year dividend growth: 8.6%

- 3 year dividend growth: 9.0%

- 5 year dividend growth: 10.2%

- 10 year dividend growth: 11.2%

Dividend growth for PG appears to be decelerating over the last decade. 8.6% growth is still not bad, but I do not see dividend growth being able to speed up unless EPS beings increasing again.

With a starting yield of 2.8% and a growth rate of about 9%, PG’s yield on cost will grow to about 7% in 10 years. In order to double the dividend, using the rule of 72, it will take approximately 8 years.

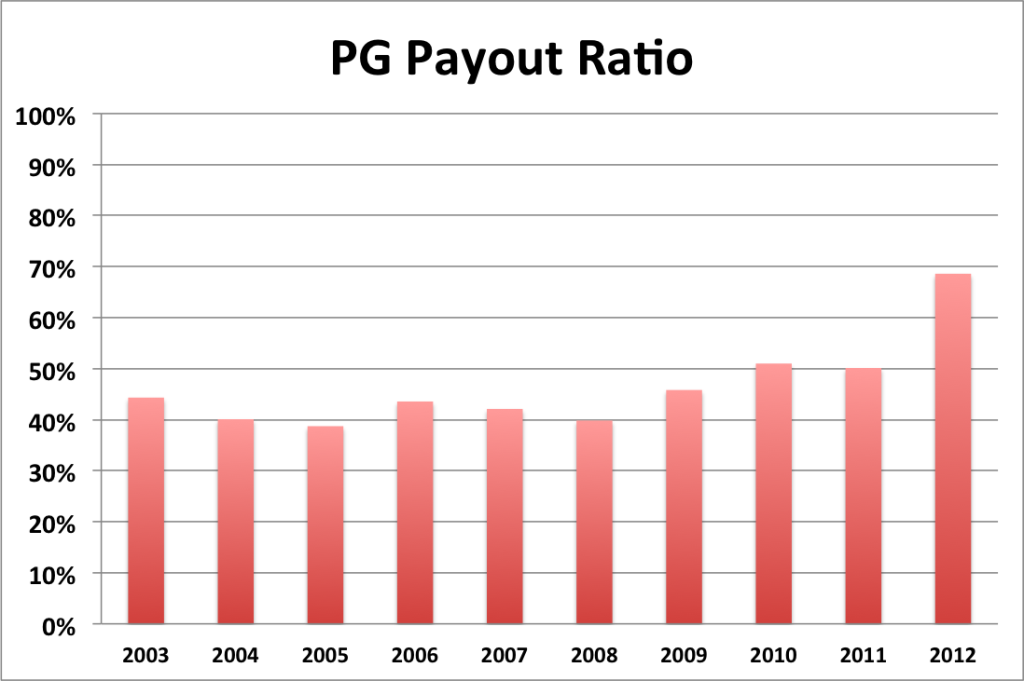

PG Payout Ratio

PG’s payout ratio has remained relatively flat in the 40 range before 2008. However, afterwards it has creeped up to 50%. In 2012 the payout ratio was almost 70% due to a drop in earnings. This spike is likely transient, but the overall trend upwards in payout ratio is likely real. Unless PG can begin growing its earnings again, it’s going to have a hard time continuing to increase it’s dividend.

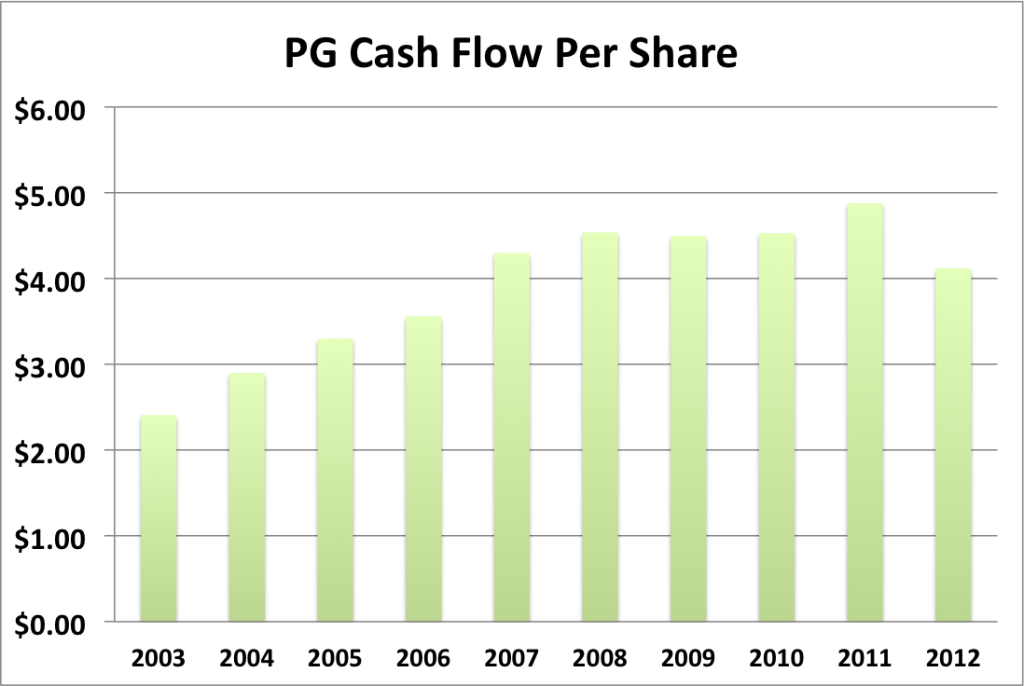

PG Cash Flow & Revenue Growth

- 1 year revenue growth: 1.4%

- 3 year revenue growth: 3.0%

- 5 year revenue growth: 0.1%

- 10 year revenue growth: 7.6%

PG’s revenue growth and cash flow further confirm what the EPS and dividend growth numbers above are showing. Namely, that PG is having a hard time increasing it’s revenue over the last 5 years or so.

PG Balance Sheet

The current debt to equity ratio for PG about 36%, which is a bit lower than other equities (~40%). The debt to equity ratio has also remained stable for the last 5 years.

PG Risks

PG has several risks to it’s business that are worth noting. First and foremost, just how much innovation is left in the personal and home care products universe? Not to be too sarcastic, but just how many more blades can they stick on a razor and still have someone notice a difference? Without innovation new competitors can spring up relatively easily in the form of other major worldwide brands, generic products, niche brands with a unique marketing kick (e.g. Seventh Generation).

PG also has low exposure to emerging markets, which is a shame because these markets are areas where PG should be able to experience some incredible growth.

PG Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for PG is $48.79. The current stock price is well below that, suggesting that PG may be overvalued at the moment.

Two Stage Dividend Discount Model

Using a risk free rate of 2%, an expected return of 10% and the beta of 0.31, the CAPM model provides a discount rate of 12.5%. Using an initial growth rate of 9% for 5 years and a slower growth rate of 7%, the two stage model produced a value of $50.04. I also tried this model with a discount rate of 10% and got $89.86.

Gordon Growth Dividend Discount Model

Using the 12.5% discount rate, this model returns a value of $62.98. Using a more conservative 10% discount rate we get a value of $174.54.

Valuation Conclusion

Of the five different models tested, the median value is $62.98, which is lower than PG’s stock price suggesting that it is overvalued at the moment.

PG Cash Secured Puts

PG seems like it’s overvalued by way of PE ratio or valuation models. Short term puts might be worth selling, as the rising market overall should prevent assignment. But in the long term, I suspect that many overvalued stocks will deflate so I wouldn’t sell a long term put against PG since I don’t want to own PG at its current prices.

Conclusions

Overall, I feel that PG makes good products. However it appears to be overvalued at the moment, has a decreasing dividend growth rate, and relatively flat earnings and revenue growth. I might consider an investment on a substantial dip in price, but not currently

Disclosure: Noting to disclose.

Readers: What are your opinions about Proctor and Gamble?

Filed under: Stock Analysis · Tags: pg, proctor and gamble, stock analysis

This is great information. I am hoping to get back into investing soon and looking for stocks that pay dividends. This was one company I would have researched so you saved me some time. Thank you for providing this information.

Thanks! I’m glad that you liked the write up. I try to put an analysis out every Monday. Read mine and other people’s (like Passive Income Pursuit, Dividend Monk, and Dividend Growth Investor) analyses to constantly educate yourself about companies. By the time you’re ready to get back into investing, you’ll have a short list of potential companies to invest in.

I’m a little concerned about their growth going forward and would really like to see more of a push to the emerging markets. I remember reading an article about how Unilever is the dominant player in most of the emerging markets. If PG can make progress there that would be a huge driver of growth and it wouldn’t surprise me to see another decade or two of 10%+ DG.

What DG did you assume in the GGM model, that 10% discount rate value seems awfully high? Ah, just playing around with it I see you used the 8.6% rate. The GGM always give squirrely numbers when the growth rate approaches the discount rate, but it’s a good quick estimate as long as the inputs are solid.

I definitely won’t be a buyer of PG at current prices. I’d need it to come down to around $70 before seriously considering adding to my position, only a 14% pullback is that too much to ask. The market runup this year has been pretty crazy. Thanks for the analysis.

PG’s emerging market push is kind of anemic at the moment. I’m hoping that they can turn this around in the future.

I used around 8% in the GGM model. I’ve had trouble with the crazy estimates that occur as the growth rate approaches the discount rate before. That’s why I usually do a number of different models. Though still not as many different ones as you do.

PG is a great company, but currently overpriced. Eventually, it may come down a bit and I’ll reconsider investing in it when that happens.

Hi MFIJ,

I’ve been following your blog and I’m really impressed by it. You just gained another regular MFIJ reader. =)

Recently, I’ve decided to change my approach in investing, i.e. to include more dividend stocks in my portfolio. This approach is most practical for me.

Thanks for the detailed analysis and keep the posts coming!

Janice,

Thanks for commenting. I’m glad that you like the blog. I’m glad that you enjoyed the analysis. I’m trying to put one out every Monday.

Good luck with your move into dividend growth investing. If you’re willing to put in a little time and effort, it can be very fun and profitable.

I agree with Alan, this is great info. I will begin investing (being that our debt will be gone and emergency fund will be fully funded) within the next 6 months, so I enjoy reading these posts about certain stocks. I will most likely start off by going with the mutual fund route, but I’m not opposed to dividend investing either.

Congratulations on knocking out your debt and getting yourself to a position where you can begin investing. Mutual funds are a great place to start. I like low cost S&P500 index funds.

As you can probably tell, I prefer to invest in individual stocks. But this approach isn’t for everyone. If you are unwilling or unable to put in the effort to research companies before you invest, you’re better off sticking with index funds.

Their massive distribution channel is their biggest moat at this point. I wouldn’t worry too much about upstart competition. They’ll crush anyone creeping into their space like a bug.

P&G has a great distribution channel, but I’m a bit worried about their lackluster push into emerging markets. Certainly, if they get their act together, they’ll do great. But until that happens, it’s going to be a nagging worry in the back of my mind.

P&G does have good products but I find myself buying a lot of generic items instead because they’re cheaper. I’ve never owned the stock either although I’m sure it’s captured in one of the ETFs I hold.

I buy a lot of generic items myself. But I’ve probably got something made by P&G around the apartment. They’re so ubiquitous, that they’re hard to avoid.

I really like how you did this stock analysis (relatively new to your site, not sure how often you do them). P&G is a force to be reckoned with for sure, but I have to imagine that at some point some other companies will cut into their market share. With that being said, I haven’t seen it happen yet and we use a variety of P&G products. Heck, sometimes they have their own coupon inserts…pages and pages of P&G product coupons. Not many companies could do that.

Thanks! I’m glad that you like the analysis. I try to put one out every Monday.

PG is always at risk of other companies cutting into it’s market share since it makes very basic commodities that have a low barrier to entry. But PG has solid brands with strong followings and a potent distribution and marketing system. I think that this gives them a pretty solid moat against competition.

I agree that P&G could gain something by going global. Their products are inexpensive to manufacture and with a good marketing campaign they could really benefit.

I can’t really fathom why PG isn’t pushing their products into emerging markets more. This is something that I hope that they fix in the future.

LOVE PG Own a bunch of shares and probably always will.

Own a bunch of shares and probably always will.

Good analysis.

Mark

“PG also has low exposure to emerging markets, which is a shame because these markets are areas where PG should be able to experience some incredible growth.”

Other articles have said PG is doing much better than competitors in emerging markets. For example, Pampers disposable diapers are the #1 selling diaper in all of China. 43% of ALL sales were to Central & Eastern Europe, the Middle East, Africa, Asia, and Latin America.

PG claims to sell to 4.4B of the world’s people and is seeking to expan to 5.0B.

P.S. That 43% was for ALL PG revenues and is from the 2012 Annual Report.