My Financial Independence Journey » Stock Analysis » Coca Cola (KO) Dividend Stock Analysis

Coca Cola (KO) Dividend Stock Analysis

Coca Cola (KO) is is the world’s largest producer of soft drink concentrates and syrups, as well as the world’s biggest producer of juice and juice-related products. Coca Cola’s products are sold in over 200 countries world wide and it owns or licenses over 500 brands. You’re probably already aware of many Coca Cola products, but did you know that they also make Fanta, Full Throttle, Sprite, Barq’s, Pibb Xtra, Mello Yello, Tab, Fresca, and Aquarius. Over the years there has been more growth in on carbonated beverages than carboanted ones, but that won’t stop KO because it also owns the Dasani, Minute Maid, and Powerade brands among others.

Coca Cola (KO) is is the world’s largest producer of soft drink concentrates and syrups, as well as the world’s biggest producer of juice and juice-related products. Coca Cola’s products are sold in over 200 countries world wide and it owns or licenses over 500 brands. You’re probably already aware of many Coca Cola products, but did you know that they also make Fanta, Full Throttle, Sprite, Barq’s, Pibb Xtra, Mello Yello, Tab, Fresca, and Aquarius. Over the years there has been more growth in on carbonated beverages than carboanted ones, but that won’t stop KO because it also owns the Dasani, Minute Maid, and Powerade brands among others.

KO Basic Company Stats

- Ticker Symbol: KO

- PE Ratio: 19.56

- Yield: 2.8%

- % above 52 week low: 62.5%

- Beta: 0.33

- Market cap: $180.3 B

- Website: us.coca-cola.com

KO vs the S&P500 over 10 years

KO has roughly tracked the S&P500 over the last 10 years. Over that time, an investment in KO would have grown by 75% compared to the 64% that an investment in the S&P500 would have grown.

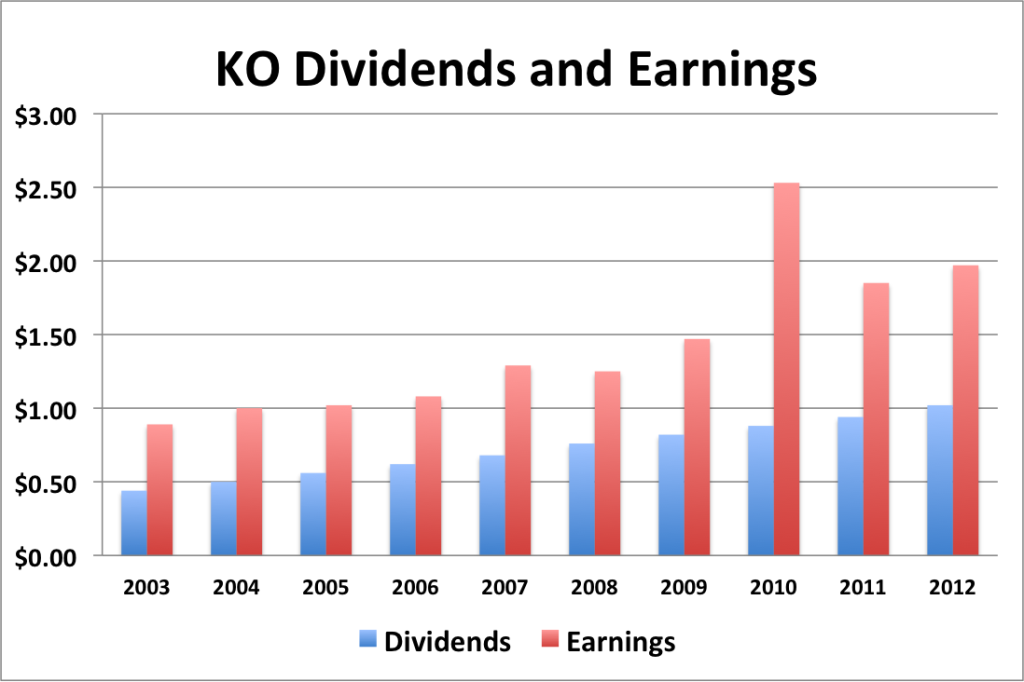

KO Earnings Per Share (EPS) & Dividend Growth

- 1 year EPS growth: 6.5%

- 3 year EPS growth: -11.8%

- 5 year EPS growth: 12.0%

- 10 year EPS growth: 9.2%

EPS growth for KO was generally upwards with a slight dip in 2008 and a big spike in 2010.

- 1 year dividend growth: 8.5%

- 3 year dividend growth: 7.7%

- 5 year dividend growth: 7.6%

- 10 year dividend growth: 9.8%

Dividend growth for KO has been solid. 9.8% over 10 years is pretty solid growth for an established company like KO. And if we look at the 1, 3, and 5 year dividend growth it looks like it might be accelerating. Another good sign for a dividend investor.

With a starting yield of 2.8% and a growth rate of about 8.5%, KO’s yield on cost will grow to well in excess of 6.8% in 10 years. In order to double the dividend, using the rule of 72, it will take less than 8.5 years.

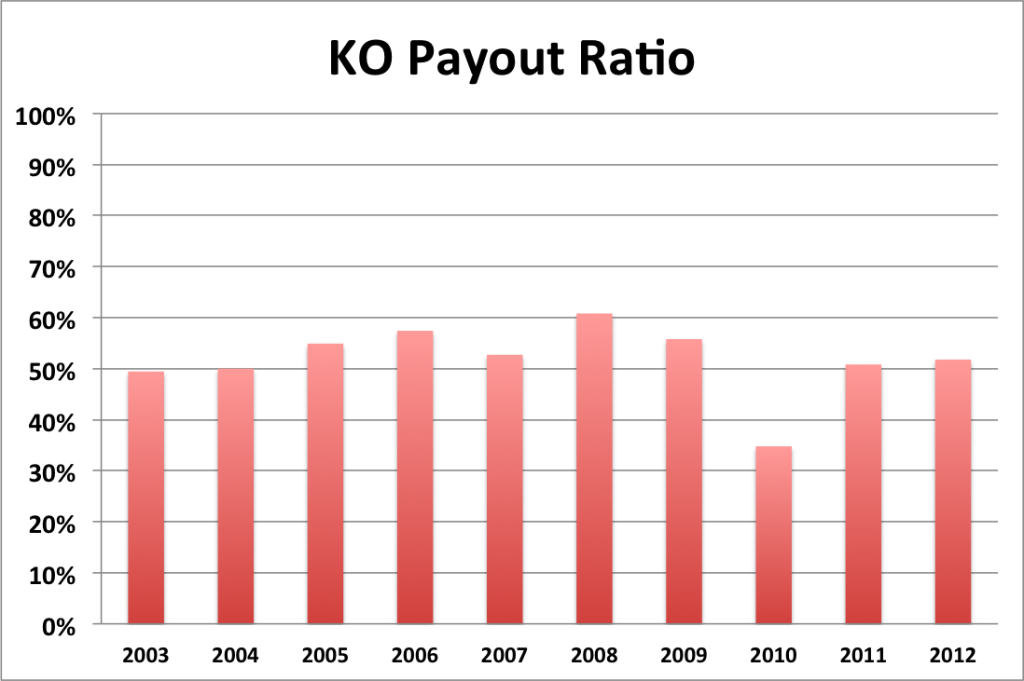

KO Payout Ratio

KO’s payout ratio has been generally hovering in the 50% range. It did dip a bit in 2010 due to the spike in earnings but quickly returned to its historic norm.

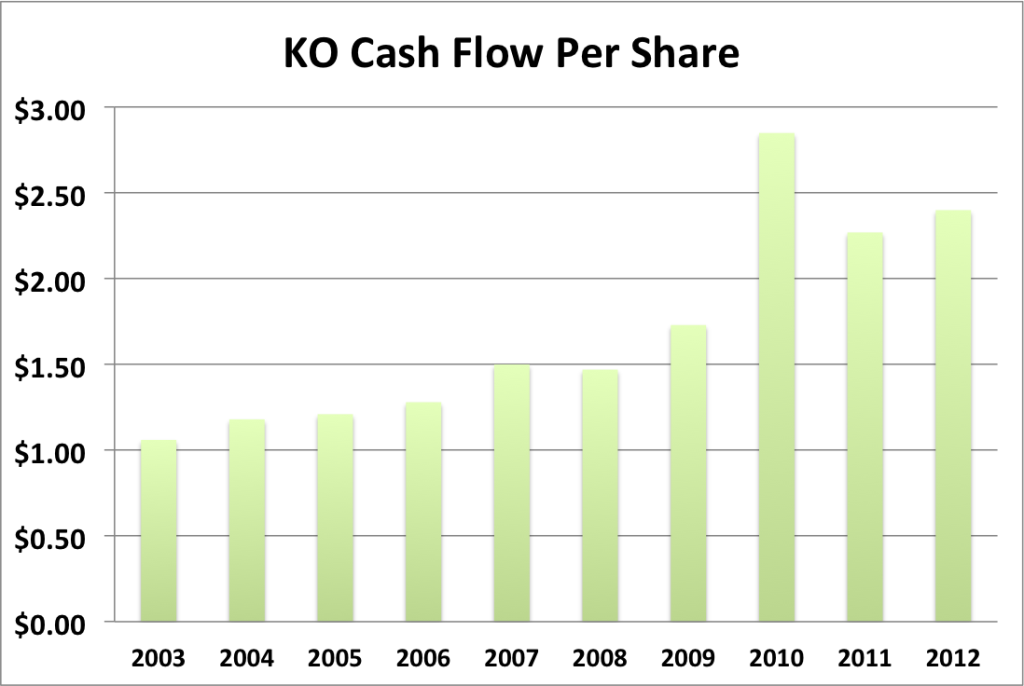

KO Cash Flow & Revenue Growth

- 1 year revenue growth: 3.2%

- 3 year revenue growth: 16.9%

- 5 year revenue growth: 10.7%

- 10 year revenue growth: 9.6%

KO’s cash flow has generally mirrored it’s EPS, slightly dipping in 2008, spiking in 2010, but otherwise displaying a nice constantly upwards trend. Revenue growth has also been quite respectable over the last 10 years as well.

KO Balance Sheet

The current debt to equity ratio for GE is about 45%. There has been an increase in debt to equity over the last 10 years, but it appears to have leveled out around 45%. I don’t see anything to worry about here.

KO Risks

I’d like to say that the rapid growth in non-carbonated beverages would be a hindrance to KO, but I can’t because as I mentioned above, KO owns popular brands like Dasani and Minute Maid.

Because KO does business all over the world it is subject to currency fluctuations. But it hedges against these through the use of currency futures and options. These markets are prone to speculation so there is always the risk that some aggressive speculator (eg George Soros) could cause problems.

Overall, I just don’t see KO facing any major risks at this time. It’s good to be the king of soft drinks.

KO Valuation Panel

Graham Number

The Graham number represents one very simple way to value a stock. The Graham number for KO is $17.71. The stock price is higher than the Graham number, suggesting that KO may be overvalued valued at the moment.

Two Stage Dividend Discount Model

KO’s dividends are currently growing at around 8.5%. Since there isn’t a period of rapid dividend growth, the two stage model won’t be useful for KO.

One Stage (Gordon Growth) Dividend Discount Model

Using a growth rate of 8.0% and a 10% discount rate, the one stage model produces a value of $60.48 (undervalued). Using a discount rate of 12.6% as predicted by the CAPM model (2% risk free rate; beta 0.33), provides a value of $26.07 (overvaluled).

Valuation Conclusion

Of the different models tested, 2 of 3 suggest that KO is overvalued.

KO Cash Secured Puts

I feel that KO is currently overvalued, so I would not suggest buying it at current prices, nor would I suggest selling puts against it.

Conclusions

I love KO as a company. It’s a business powerhouse and a textbook dividend growth stock. At present, based on the PE ratio and my valuation panel I feel that KO is overvalued. If it dips back into fair value range, I would consider adding to my position.

Disclosure: I am long KO.

Readers: What are your opinions about Coca Cola?

Filed under: Stock Analysis · Tags: coca cola, ko, stock analysis

Nice overview. I’m not a huge fan of any Coke products, but I won’t deny they are a great company. The dividend yield and growth isn’t bad for a company with a long, successful track record.

I totally agree. I really respect them as a company and really don’t care for the products. Probably is overvalued at this point as well.

I don’t drink soft drinks, so I probably don’t send nearly as much money to KO as the average American. But most of the world loves their products and that means that they’ve got an incredible market share. I think that they’re going to be a great company for a long time.

I don’t drink many Coke products myself either. I’m just not a soft drink fan. But the rest of the world love them and Coke has an excellent market share and track record.

Nice overview MFIJ. I bought in a few months ago and think it can be a solid holding. I see some of the same risks, but they own so many different drinks that I think they should be able to weather them quite well.

I don’t think that the risks for KO are nearly as great as the risks for most of the other companies that I’ve reviewed. KO’s risks are more like speed bumps than brick walls.

CAPM suggest that with more risks comes more reward. I read some articles this weekend that suggested that this isn’t true. If you look at the performance of some blue chip companies like KO, PEP, PG, CL, etc, these companies outperformed the S&P500 while having far lower volatility as measured by beta.

I am not sure what this means for your valuation, but I guess it leans more to $60 than $26

I have mixed opinions on CAPM. I’ve been incorporating a valuation panel into my reviews for the last few months and there have been a few times where I’ve suspected that the CAPM method produced a number that I thought was strange, either way too high or way too low. That’s why I try to use both CAPM and a regular 10% discount rate. In the future, I’d like to add a few more valuation methods to get more data points.

Very good detailed review. I see those risks too but then Coke is aggressive company and I am sure in long run it will yield good returns

KO is likely going to be a strong yielder for a long time. It has so great of a market share and such a diversified product line that any risks are really minor at best.

I am just starting to really look into dividend investing. Learning more and more everyday. When I look at KO they seem to have a lot of beverages that could help them stay afloat even in bad times. Its just seems like one of those favor company. Not the flavor of the month and nothing fancy just solid.

KO is a great company. It’s one of the first dividend growth companies that I bought. You’re correct in your assumption. KO isn’t going to do anything super amazing in the short run, but it is going to just steadily grow dividends year after year. The nice thing is that I’ll probably never sell KO. It will be in my portfolio until I die, because it’s just that stabile.

Great review man. I own KO and likely always will. As a dividend growth stock, Coke is it.

Coke is one of those classic dividend growth stocks. I even know a few people who aren’t serious investors but wound up with KO stock years ago and are now loving the dividends.

I’m hoping the valuation tips more to the $60 than the $26 . I just bought into Coke recently @$40. I don’t intend to sell this position. ever. I’m expecting that when I check the stock price in 30 years time I’ll have a smile on my face….. hope I’m not wrong!

. I just bought into Coke recently @$40. I don’t intend to sell this position. ever. I’m expecting that when I check the stock price in 30 years time I’ll have a smile on my face….. hope I’m not wrong!

While I think KO is a bit overvalued at the moment, I’m pretty confident it’s one of those stocks that you’ll wind up passing on to your kids when you die. It’s just that consistent.

I’m a newbie investor and I’ve bought into KO. Glad to read this as it’s always reassuring to have your homework given a big tick! Looking forward to growing more confident in my investments for the future.

Great job grabbing KO. It’s a great company. You can probably expect to collect ever increasing dividends from KO for the rest of your life.

true KO is giving $1.10 this year and showing 8.15% five year annual dividend growth.

[...] buying Coke as a dividend stock? Head over to MiFi Journery for a complete [...]

[…] August 10, 1981- A month long boycott of Coca-Cola products ended on this date when Coca-Cola promised Jesse Jackson, head of People United to Save Humanity (PUSH), $30 million to support black-owned businesses. The Coca-Cola Company promised its support of black businesses by seeking blacks to join its board of directors, increasing deposits and loans to black owned banks, and to raise its contributions to black owned organizations to $250,000. There have been some criticism with this deal as critics point out the Coca-Cola Company reneged on its deal and only paid $11 of the $30 million promised. Photo: myfijourney.com […]

In addition, related to this article I have read more information on

http://bidnessetc.com/coca-cola-vs-pepsico-whose-dividends-taste-better/